UX STRATEGY / EMAIL SYSTEM DESIGN / content strategy

2023-2024

Engagement architecture:

Orchestrating a behaviour-driven communication strategy to convert Mitsubishi Connect trial users into loyal subscribers.

Engagement architecture:

Engagement architecture: Orchestrating a behaviour-driven communication strategy to convert Mitsubishi Connect trial users into loyal subscribers.

Orchestrating a behaviour-driven communication strategy to convert Mitsubishi Connect trial users into loyal subscribers.

#UX STRATEGY

#EMAIL SYSTEM DESIGN

2024

UX STRATEGY / EMAIL SYSTEM DESIGN

2024

State Of The Industry

A vehicle isn't the only thing that depreciates when driven off the lot - so too does brand investment in nurturing long-term connections.

Hard-won customer relationships achieved through rigorous multi-channel acquisition strategies wither into radio silence during their most formative periods of ownership - when loyalty foundations are most apt to be cultivated.

Solution Summary (TL;DR)

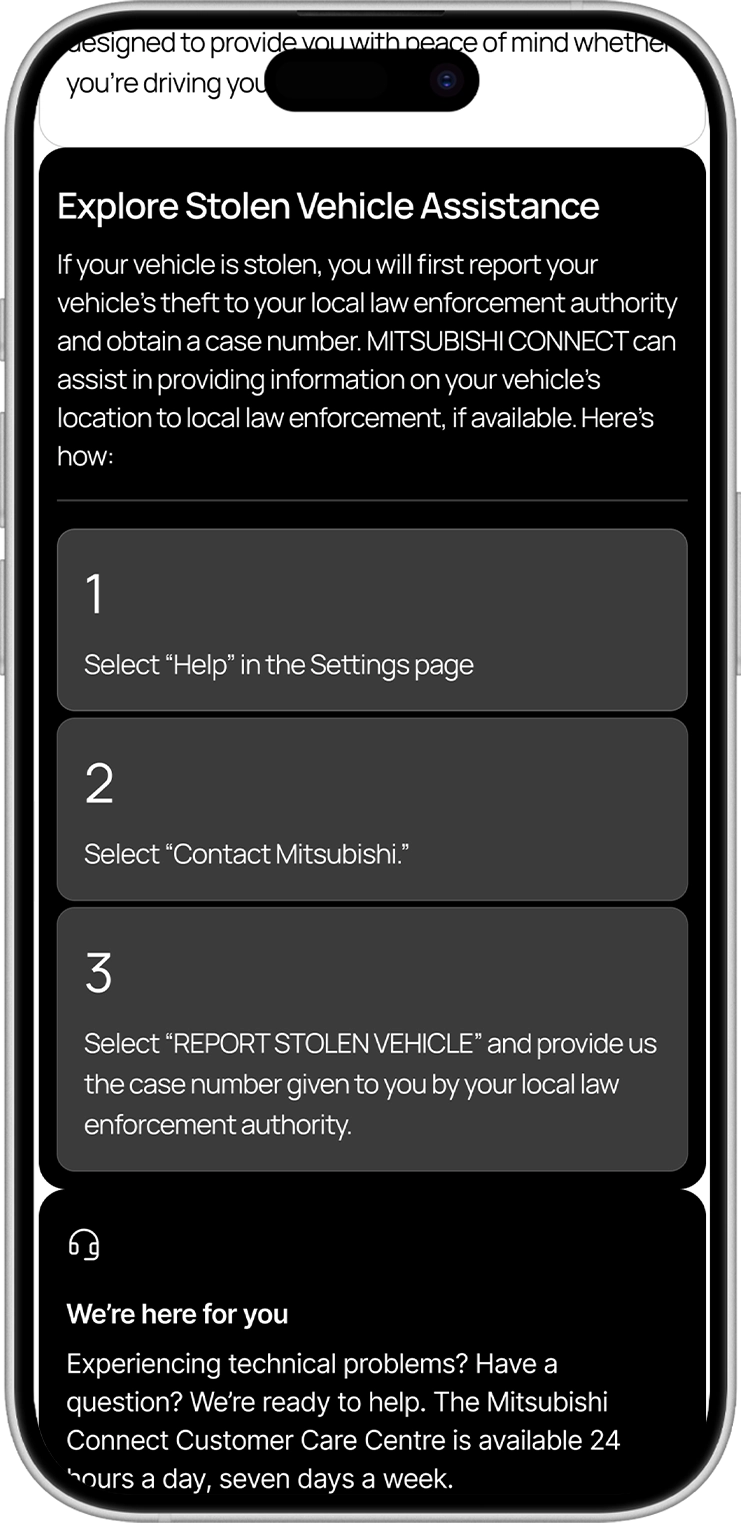

Mitsubishi approached our team with a paradoxical disconnect: despite reporting 78% adoption rates for Connected Car Services across enrolled 2-year trial periods, conversion to paid subscription rate was just 13.8%.

This value signified a more visceral experience gap within a fragmented post-purchase journey that relied on dealer communications operating in silo; creating incongruity and widespread variance in how (and how often) its value propositions were marketed to prospects and new owners.

Learn how we engineered a dynamic 2-year contact strategy that positioned CCS as an always on co-pilot owners can't live without; increasing conversion on paid subscriptions by 54% QoQ.

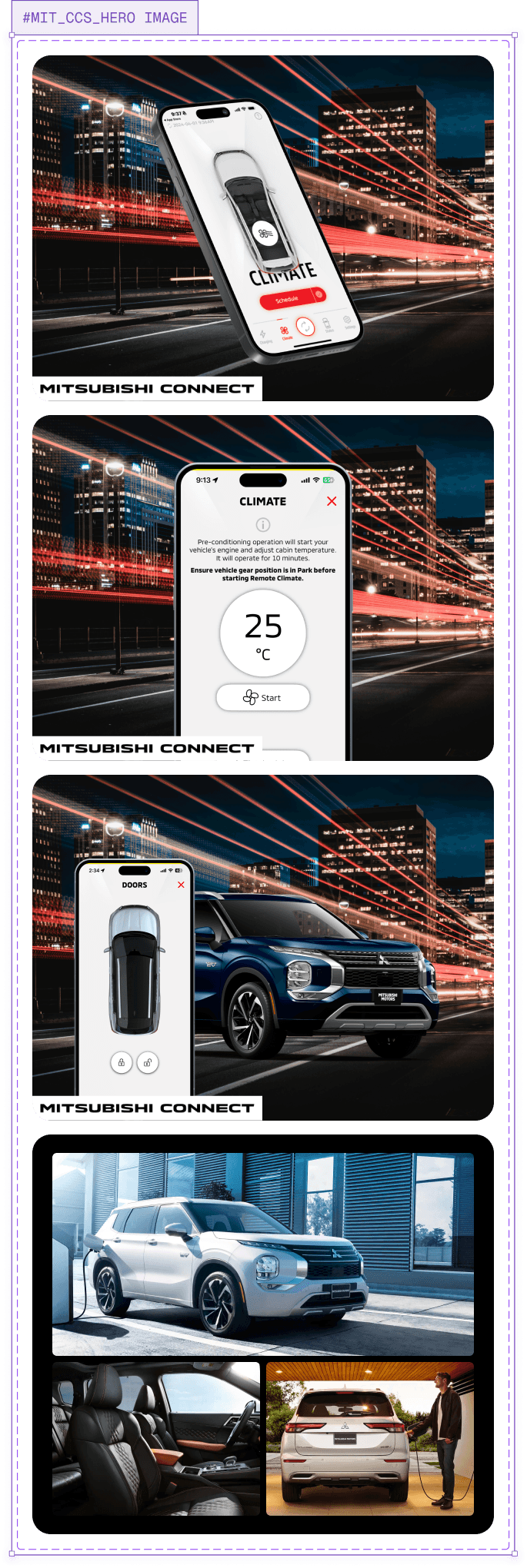

Fuel Ambition With Mitsubishi Connect

Recognizing the reality of most trips extending beyond just putting it in park, Mitsubishi Connect transcends the traditional constraints of ownership, augmenting Outlander's core functions in the plam of your hand.

Powered through the Mitsubishi Connect Mobile App, owners are inspired to reimagine a more seamless A-to-B with practical Remote and Safeguard features, alongside real-time service alerts for peace of mind on-the-fly.

Discovery: Diagnosing Route Cause

Discovery research was required to uncover friction points across Mitsubishi's existing communications strategies and isolate root cause. How (and how often) does Mitsubishi articulate CCS' core value propositions to new owners? What in-app features currently possess the highest utilization rates?

Comprehensive Psychographic Profiles featuring demographic data and purchasing conventions were issued by Mitsubishi's Global Research Team to serve as a springboard for garnering deeper understanding of our target user base.

40%

Cite All-Wheel Drive as a leading motivator for purchase, hinting at adventurous spirits beneath practical exteriors.

59%

Chose Outlander over competing brands due to Mitsubishi's highly regarded reputation for safety.

88%

State that versatility is a non-negotiable: requiring a vehicle that adapt to changing passenger and cargo needs.

82%

Listed Outlander as their first Mitsubishi vehicle, demonstrating brand ability to capture families at pivotal life transitions.

PROBLEM POSITIONING

Problem Positioning

Problem Positioning

Ultimately, owner perception of CCS was not a product of active rejection, but rather insufficient contextual awareness stemming from incongruity and variance in how and when it was being marketed.

By embedding product value in owners' lived experiences, we could sustain the brand-to-owner relationships that historically wane after purchase, while transforming passive subscribers into loyal advocates who believe in the technology augmenting their daily drive.

Owner perception of CCS was not a product of active rejection, but rather insufficient contextual awareness stemming from incongruity and variance in how and when it was being marketed.

By embedding product value in owners' lived experiences, we would nurture the brand-to-owner relationships that historically wane after purchase; transforming passive subscribers into loyal advocates.

Ultimately, owner perception of CCS was not a product of active rejection, but rather insufficient contextual awareness stemming from incongruity and variance in how and when it was being marketed.

By embedding product value in owners' lived experiences, we could sustain the brand-to-owner relationships that historically wane after purchase, while transforming passive subscribers into loyal advocates who believe in the technology augmenting their daily drive.

PROBLEM & SOLUTION SUMMARY: INSIGHTS & OUTCOMES

Mitsubishi approached our team with a rather paradoxical disconnect: despite reporting 78% usage rates for Connected Car Services across enrolled 2-year trial periods, conversion to paid subscription rate was just 13.8%.

This value signified a more visceral experience gap across a fragmented post-purchase journey that relied on dealer communications operating in silo; creating incongruity and variance in how (and how often) its value propositions were marketed to prospects and new owners.

Learn how we engineered a dynamic 2-year contact strategy that positioned CCS as an always on co-pilot owners can't live without; increasing paid conversions by 54% QoQ.

Solution Summary (TL;DR)

Mitsubishi approached our team with a rather paradoxical disconnect: despite reporting 78% usage rates for Connected Car Services across enrolled 2-year trial periods, conversion to paid subscription rate was just 13.8%.

This value signified a more visceral experience gap across a fragmented post-purchase journey that relied on dealer communications operating in silo; creating incongruity and variance in how (and how often) its value propositions were marketed to prospects and new owners.

Learn how we engineered a dynamic 2-year contact strategy that positioned CCS as an always on co-pilot owners can't live without; increasing paid conversions by 54% QoQ.

Solution Summary (TL;DR)

Mitsubishi approached our team with a rather paradoxical disconnect: despite reporting 78% usage rates for Connected Car Services across enrolled 2-year trial periods, conversion to paid subscription rate was just 13.8%.

This value signified a more visceral experience gap across a fragmented post-purchase journey that relied on dealer communications operating in silo; creating incongruity and variance in how (and how often) its value propositions were marketed to prospects and new owners.

Learn how we engineered a dynamic 2-year contact strategy that positioned CCS as an always on co-pilot owners can't live without; increasing paid conversions by 54% QoQ.

So, Who's Behind The Wheel?

Outlander drivers embody the suburban-dwelling, millennial professional straddling adventure and reliability. They're methodical thinkers who approach ownership as a strategic investment rather than a fleeting emotional indulgence.

Insights indicated a compelling hierarchy of feature affinity by model type (Plug-in Hybrid vs. Gas). But, how might these conventions align with those behind the wheel of competing automakers?

Remote Vehicle Status

51%

51%

Remote Climate Control Start

22%

22%

Remote Vehicle Finder

7%

7%

Remote Lock / Unlock

7%

7%

Canvassing the Market

With competitor email journeys gated behind ownership and VIN, generative community research was conducted through targeted Reddit inquiries; engaging Subaru and Toyota owners directly about their experiences with each manufacturer's remote services programs. Despite price being cited as a top-of-funnel impediment to renewal, respondents attributed a lack of transparency as an underlying conduit for diminished trust in brand. Connected car services were consistently onboarded to new owners as an afterthought during final paperwork; a missed opportunity to foster advocacy through meaningful education and feature demonstration when novelty is at its highest.

Problem Positioning

Ultimately, owner perception of CCS was not a product of active rejection, but rather insufficient contextual awareness stemming from incongruity and variance in how and when it was being marketed.

By embedding product value in owners' lived experiences, we could sustain the brand-to-owner relationships that historically wane after purchase, while transforming passive subscribers into loyal advocates who believe in the technology augmenting their daily drive.

Solution Architecture

Pixel pushing was preceded by data architecture and content bucketing. Our team collaborated with Strategy through a series of synchronous workshop sessions; crafting journey logic to accommodate dynamic, model-specific feature spotlights and contextual triggers that inform owners of safety critical nuances on-the-go.

Plug-&-Play: Democratizing Systems

Our approach to system design development was rooted in adaptability: empowering client with a groundwork of semantically labelled tokens to serve as a springboard for future refinement and scale. Success would be scaled through its ability to democratize technical constraints and invite cross-functional engagement in identifying new component requirements and efficiencies.

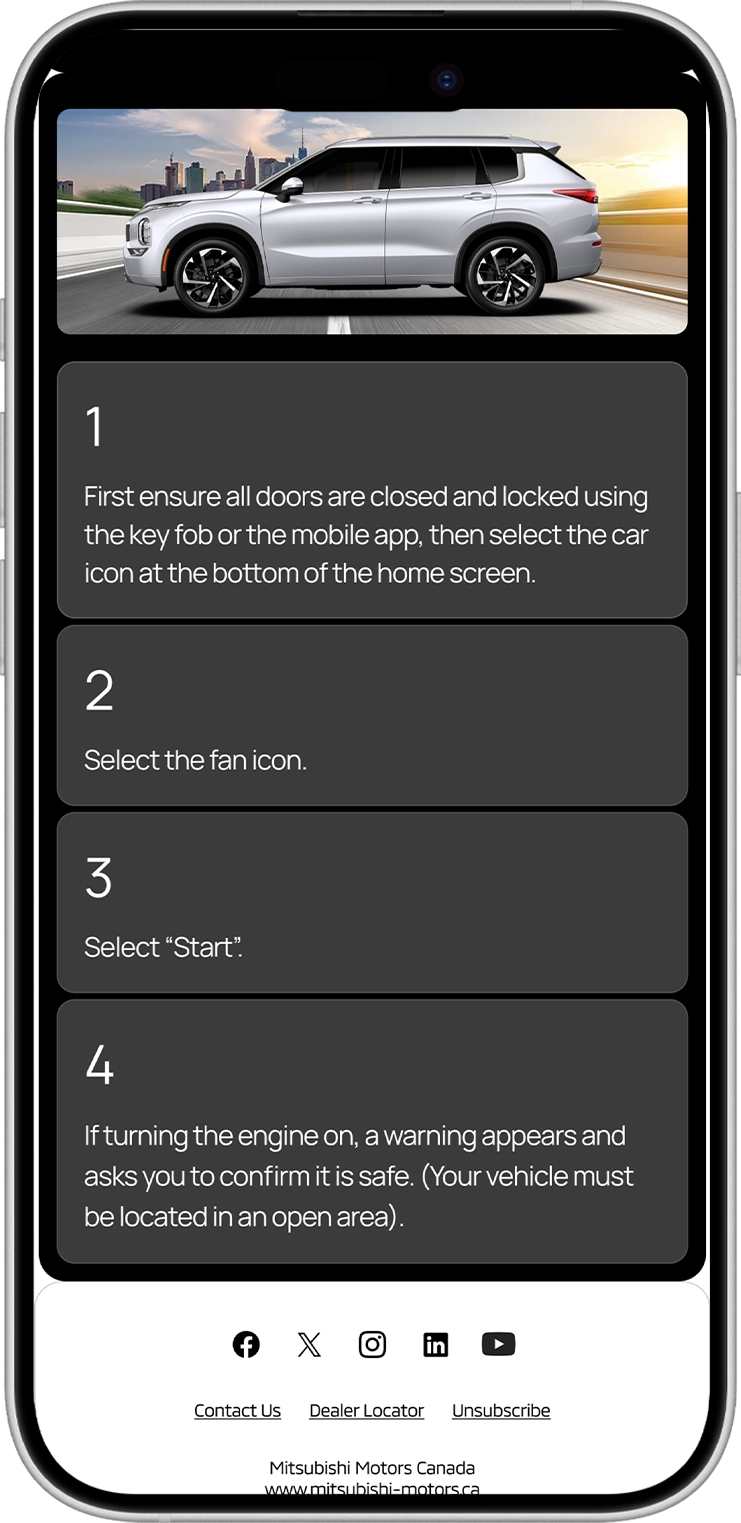

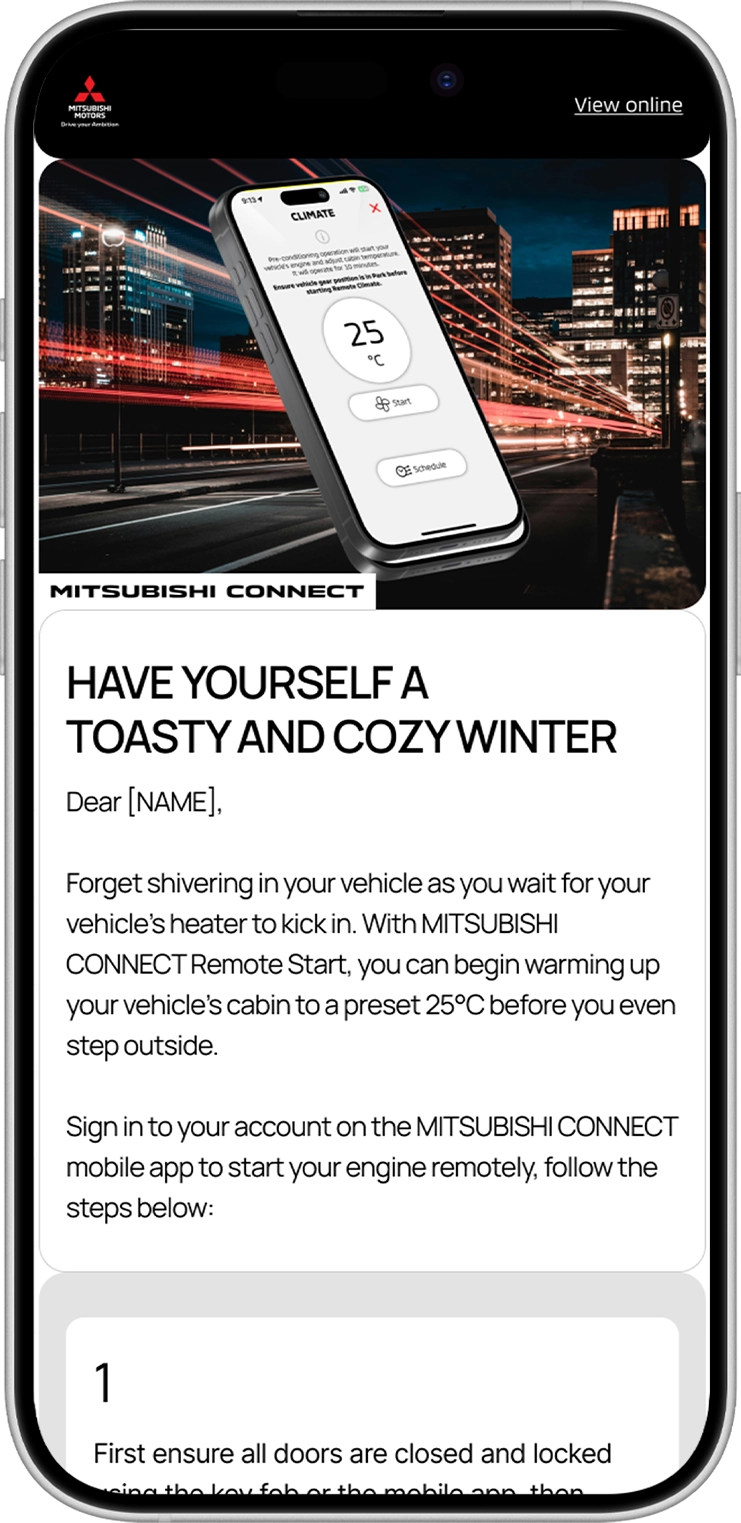

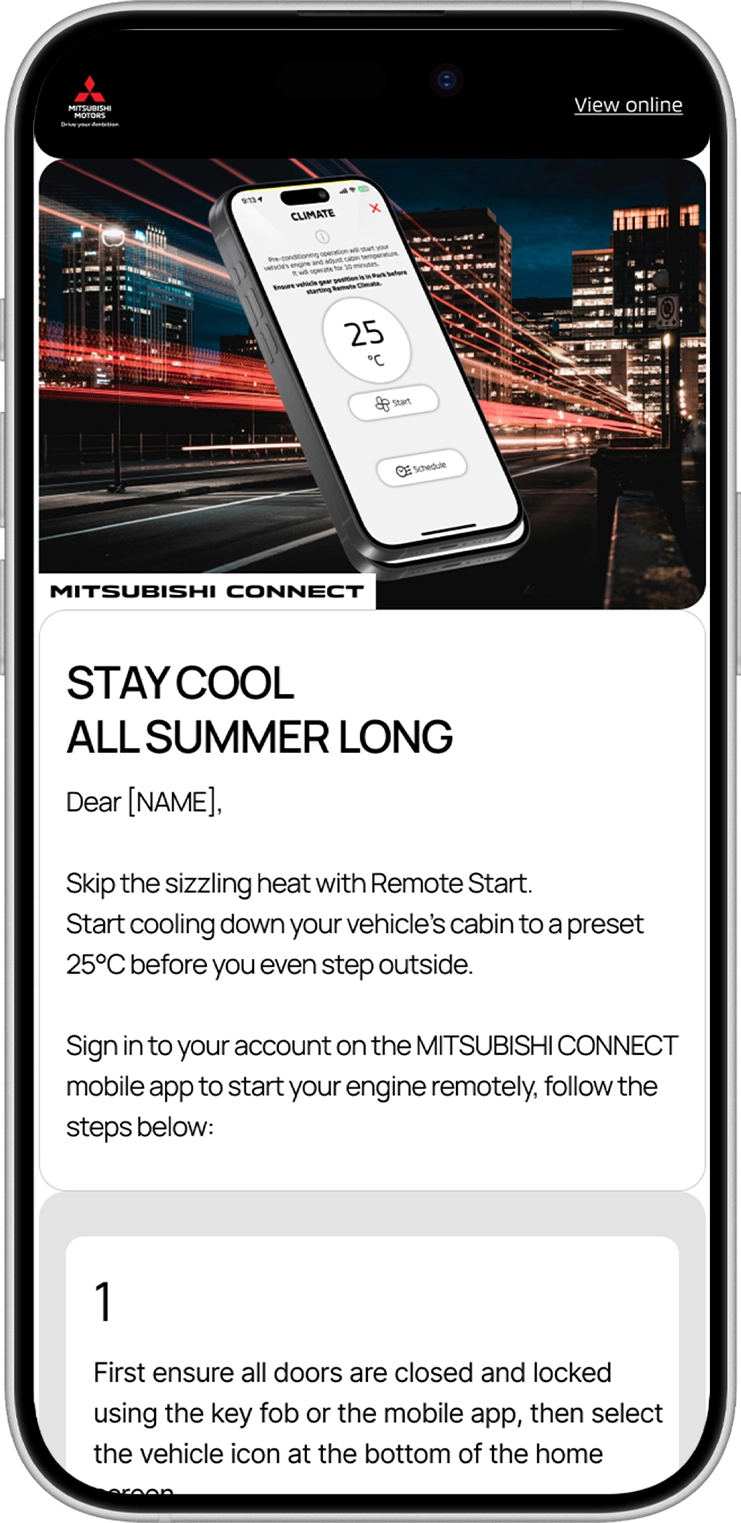

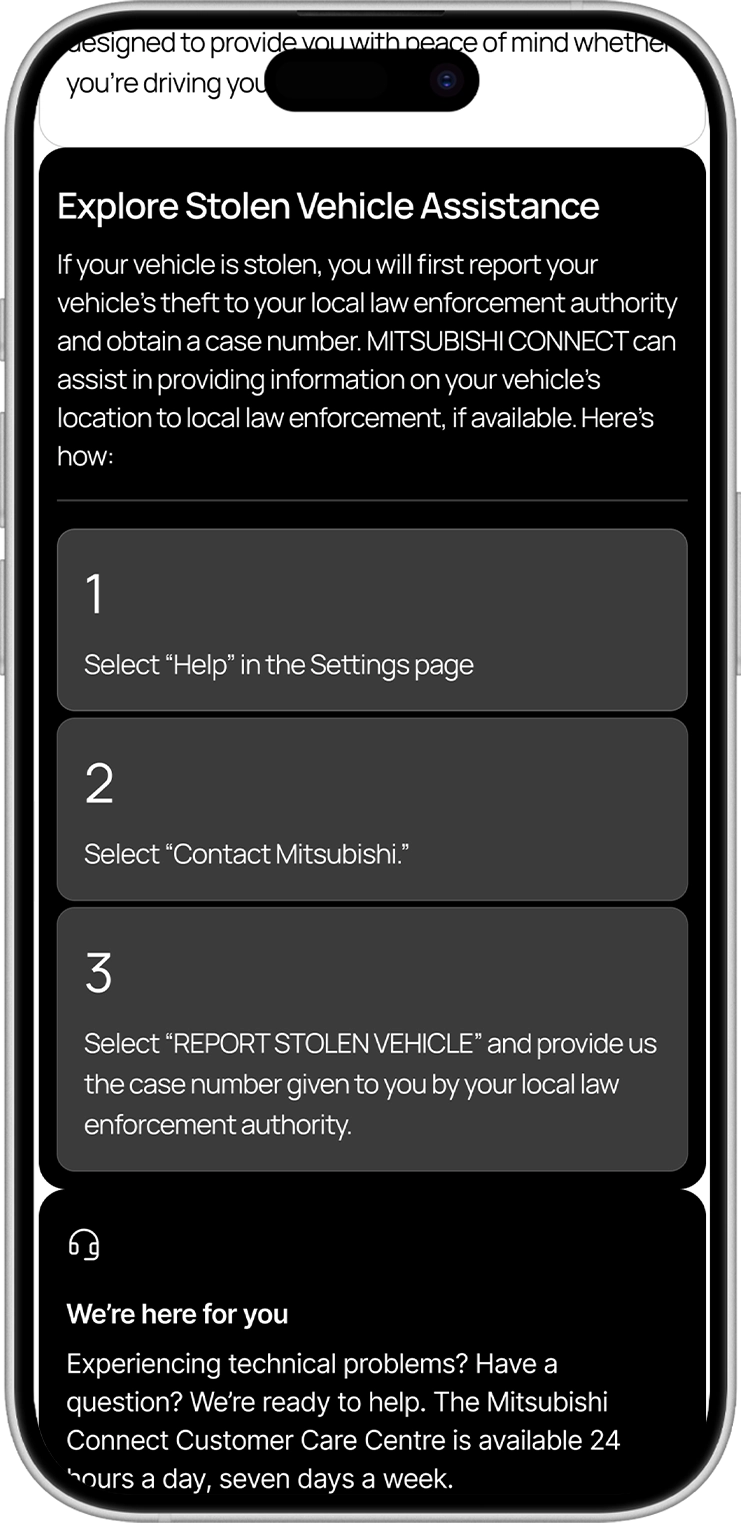

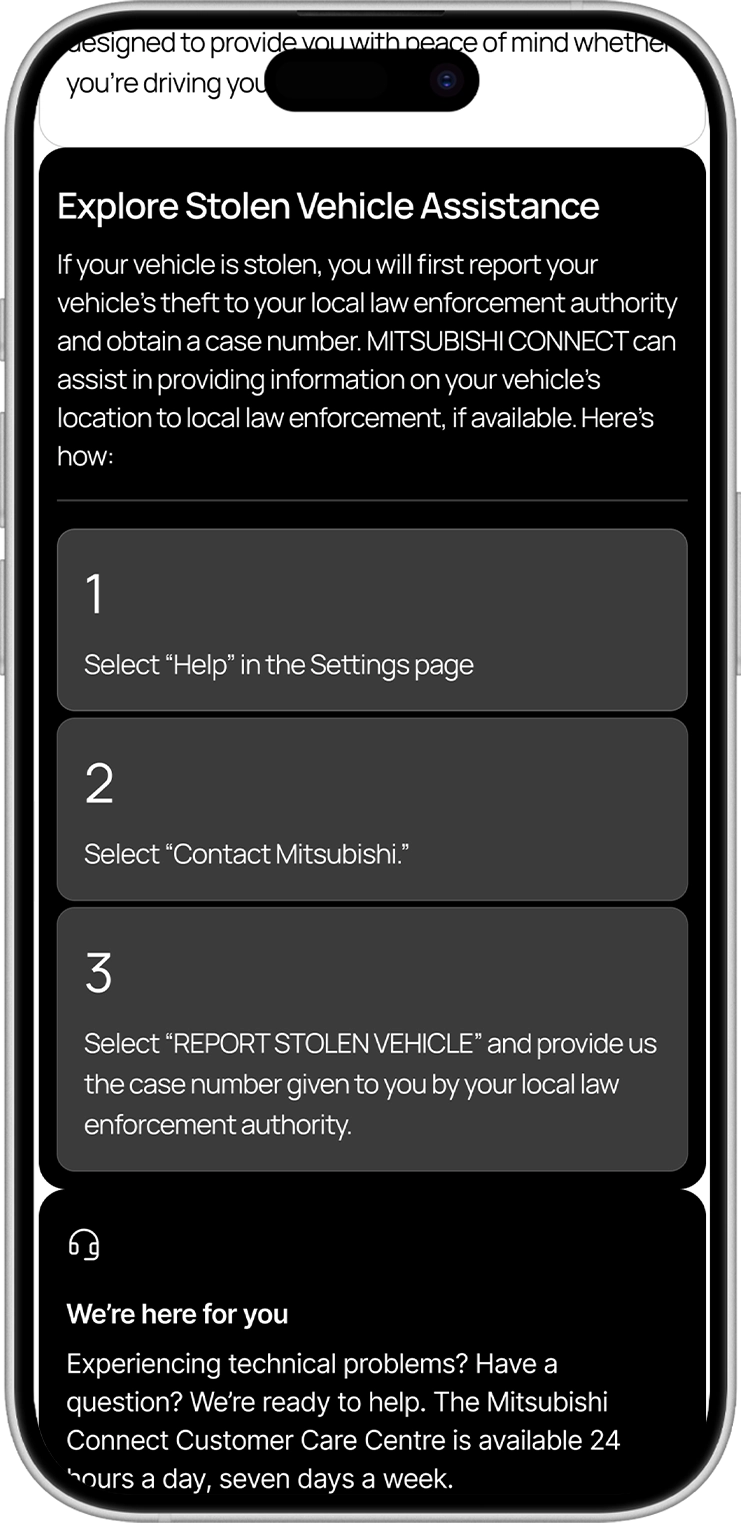

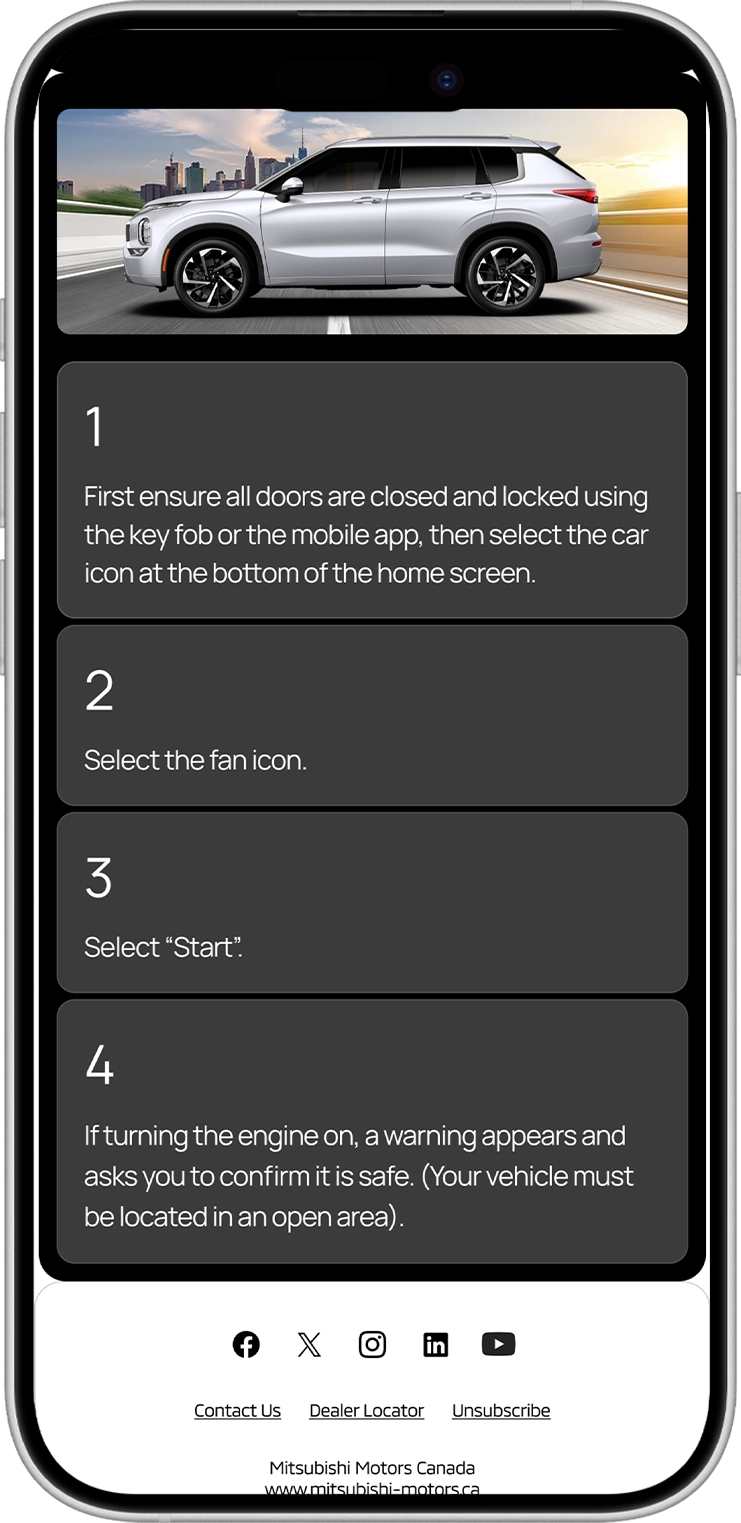

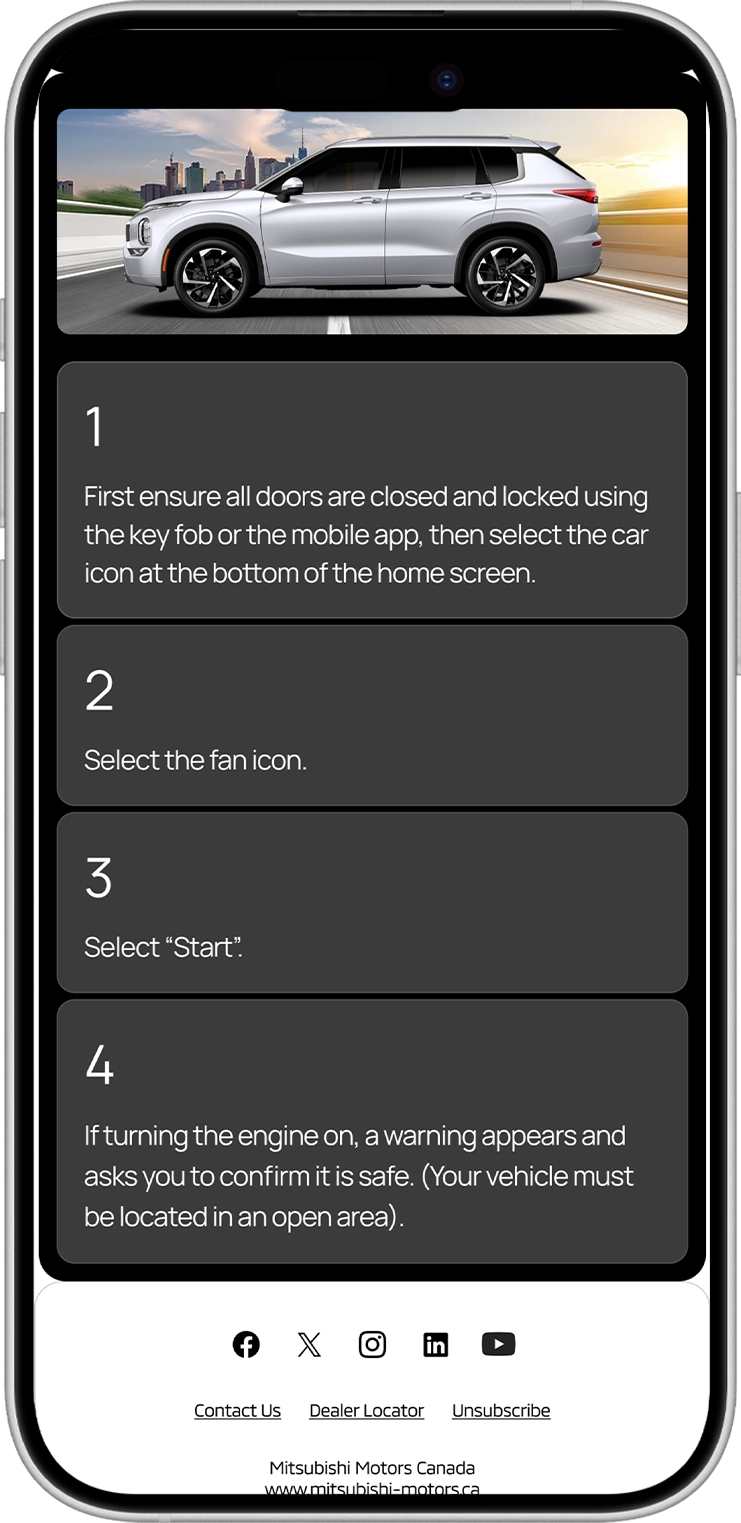

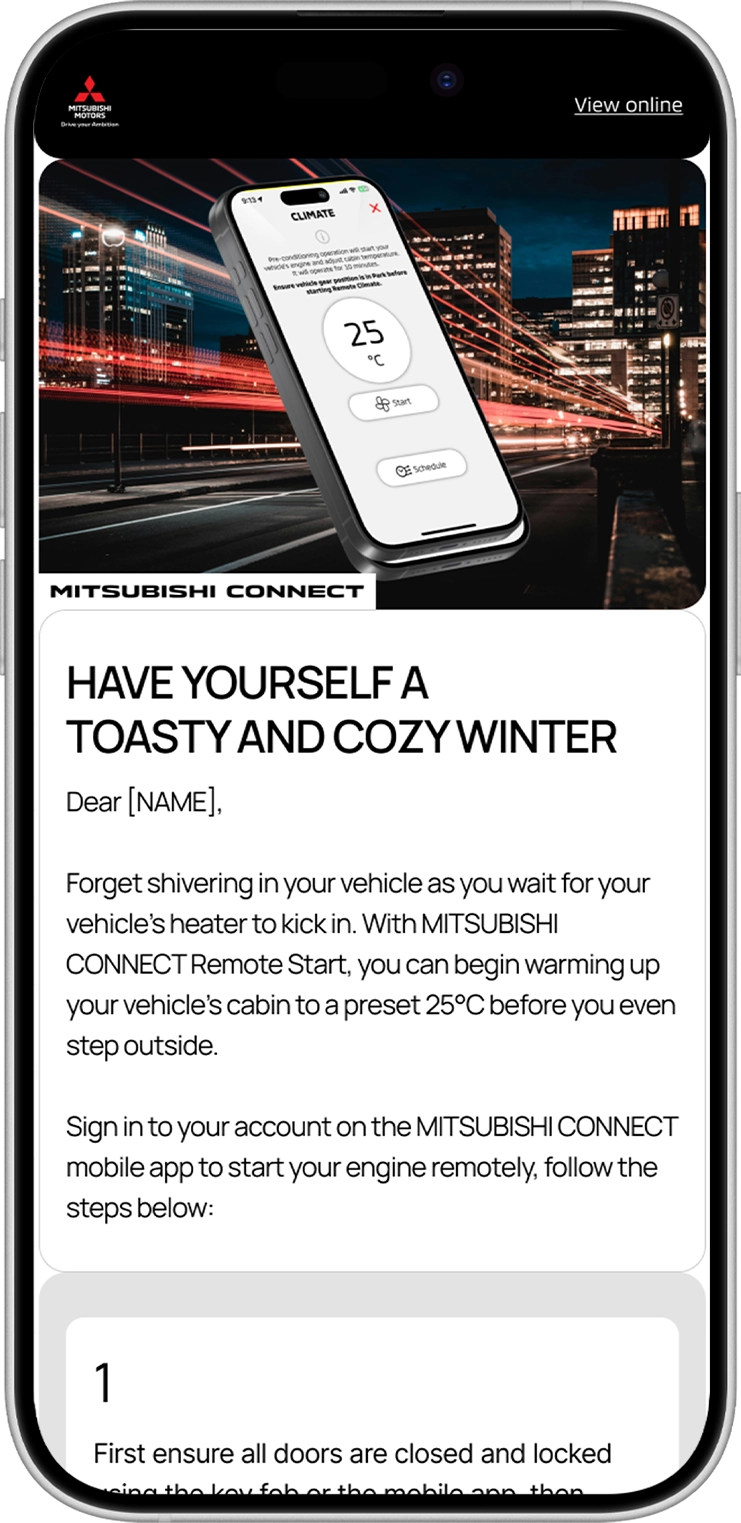

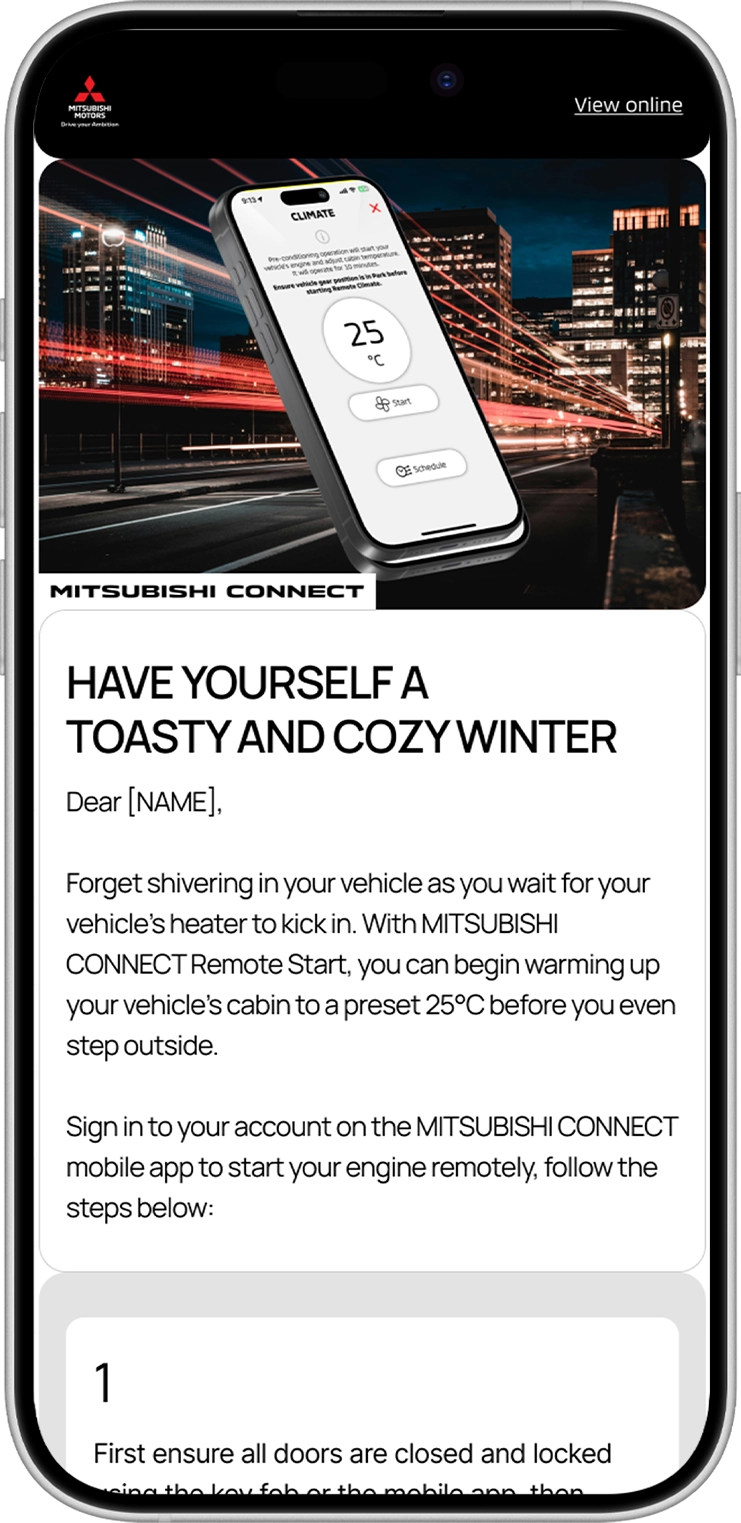

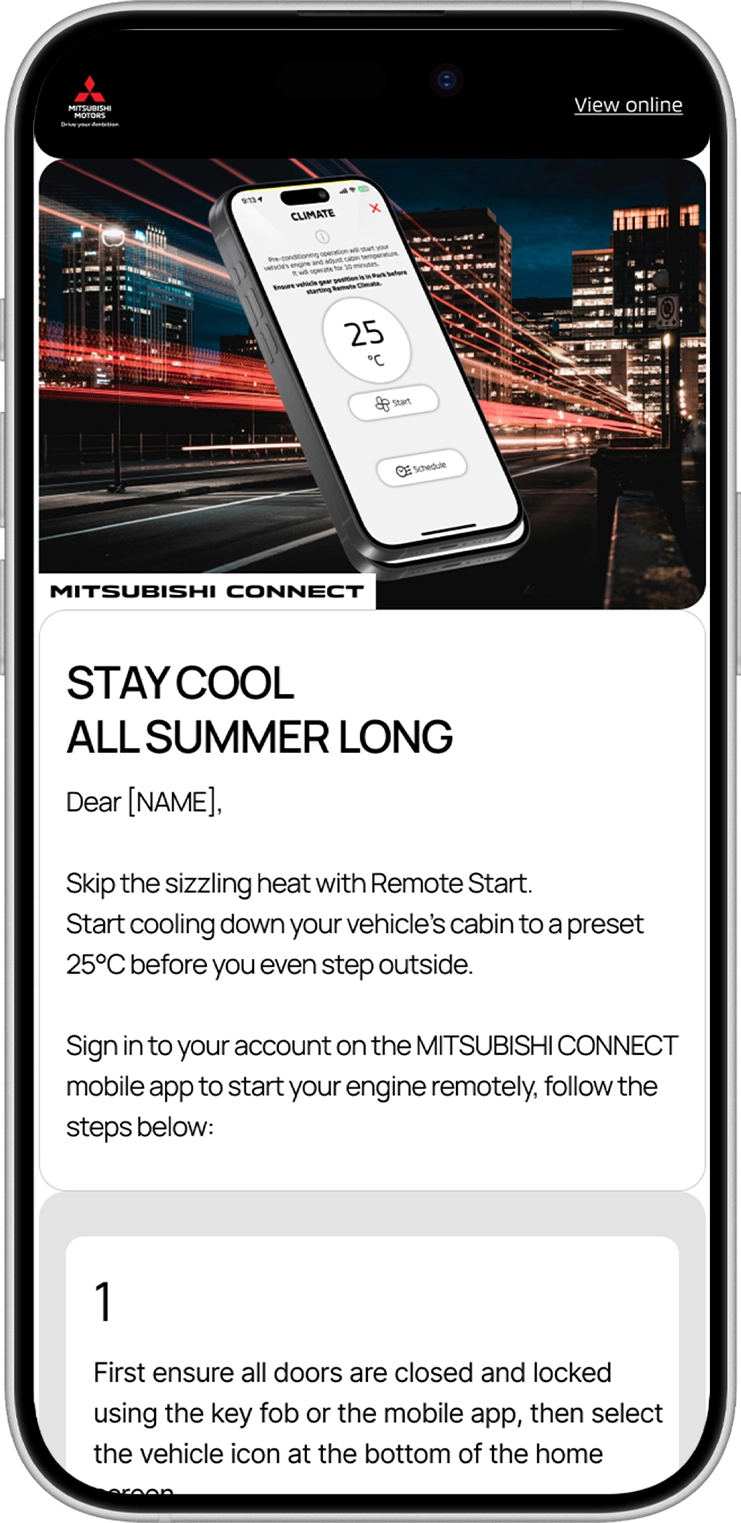

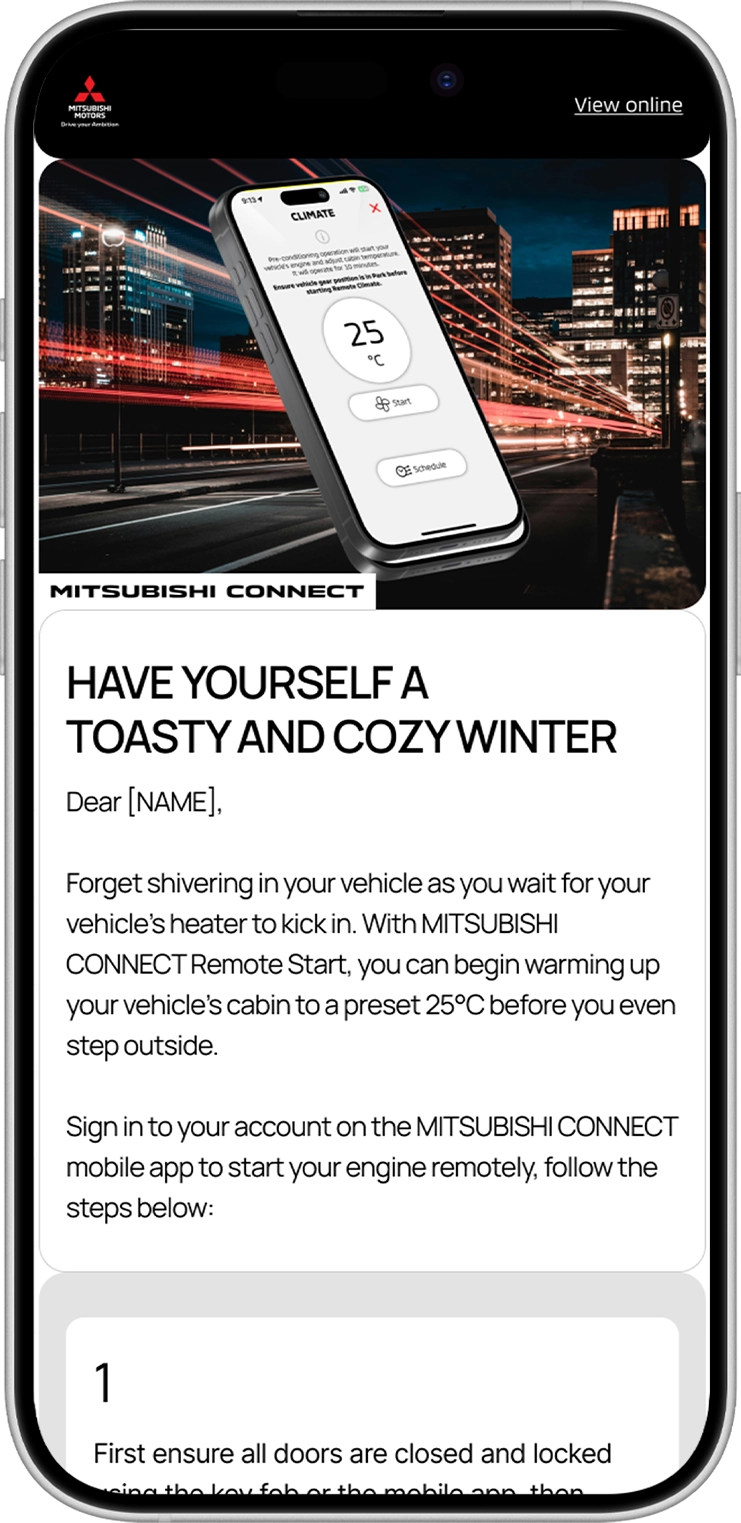

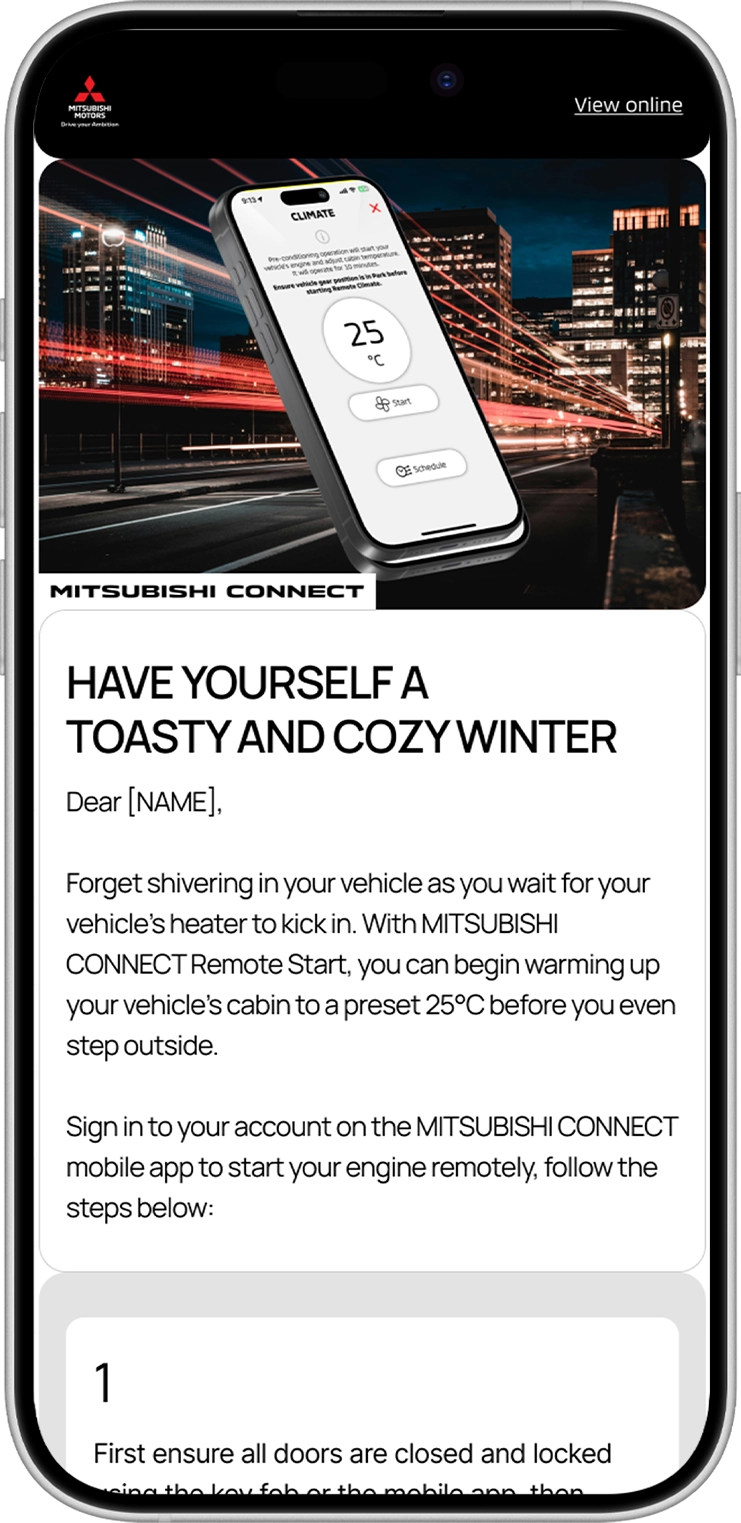

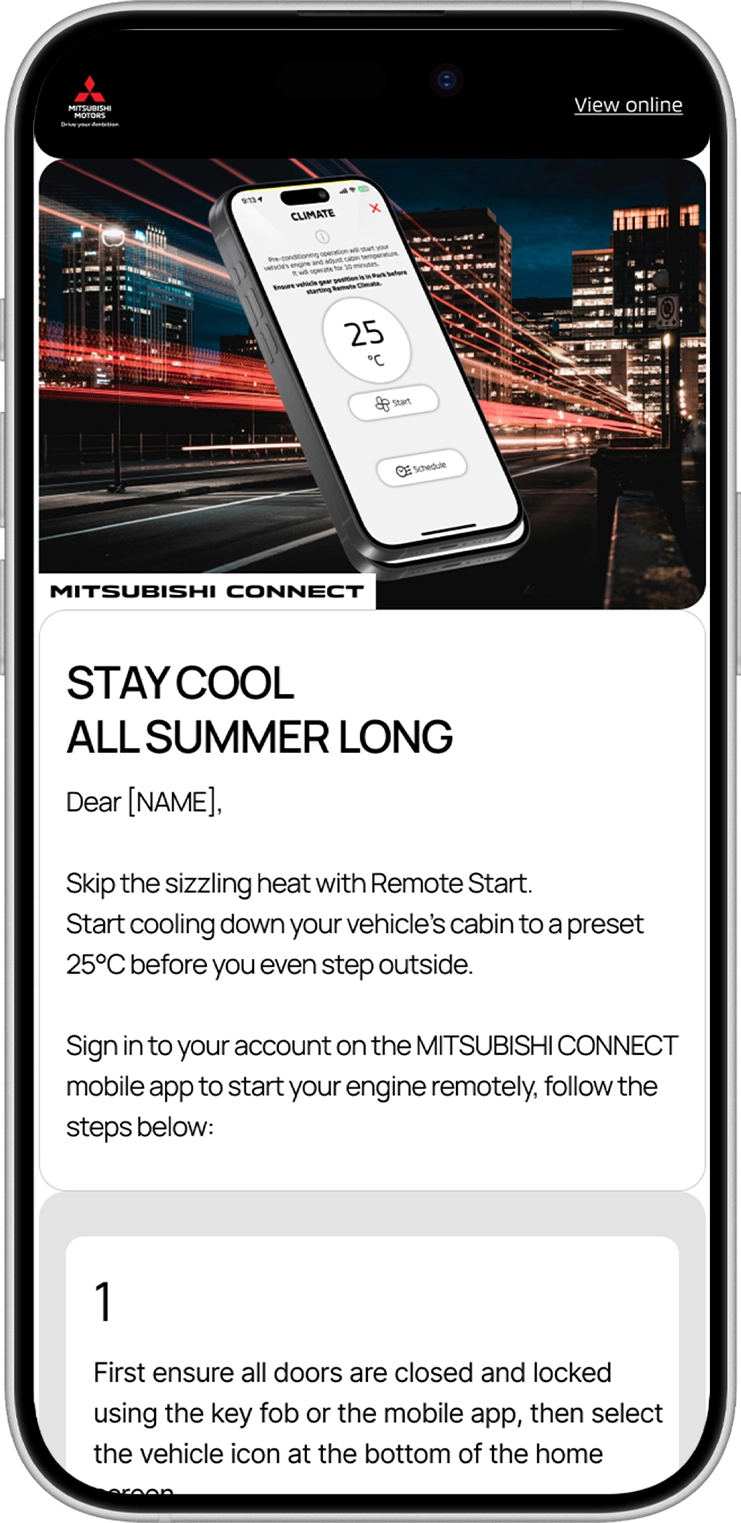

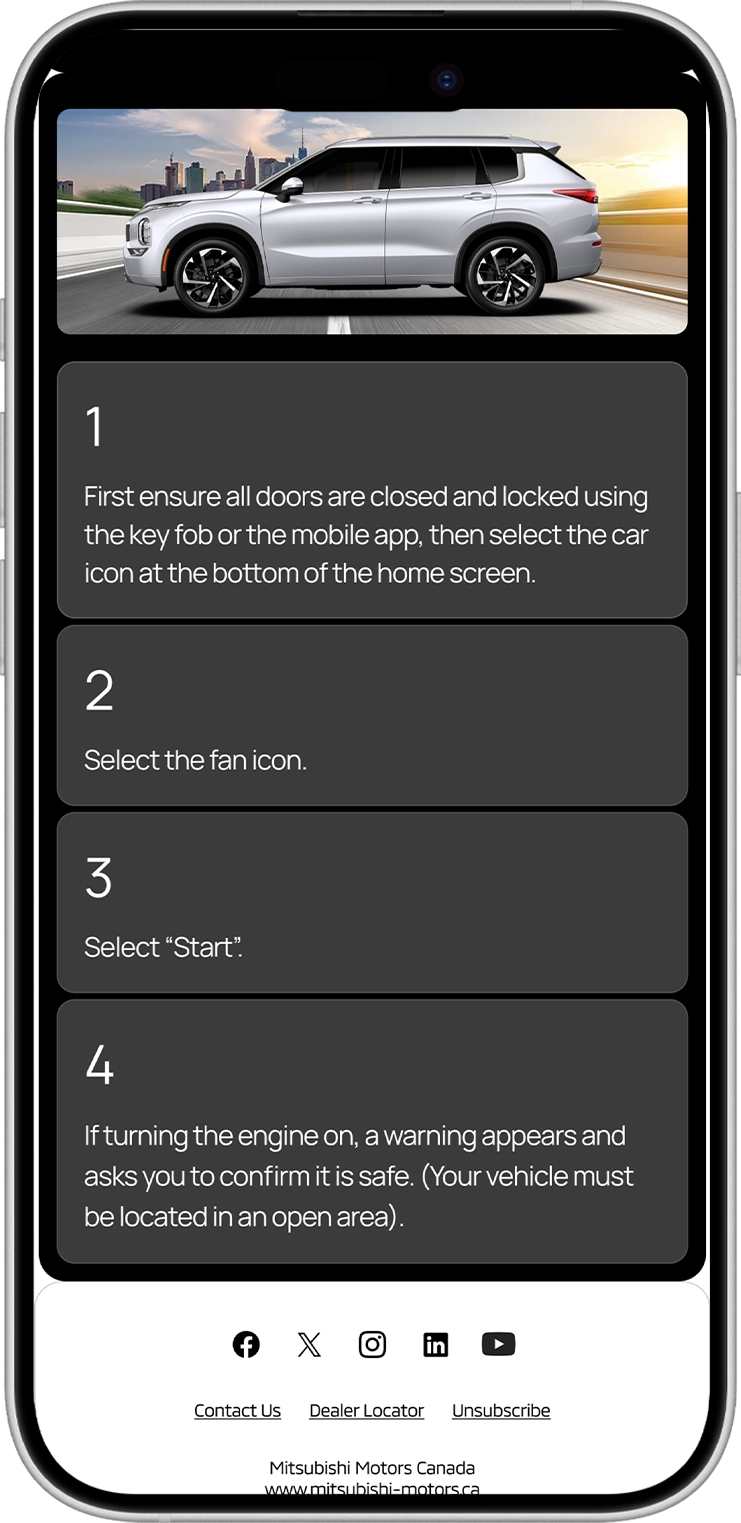

Habit Forming During Peak Receptivity Periods

The first 30 days represented strategic bets informed through existing owner insights and core purchase motivators, front-loading communications with high-affinity feature spotlights (i.e. Remote Climate Control, Vehicle Status monitoring, and Door Lock functions) to maximize perceived ecosystem value and foster habitual use when open rates (and brand engagement) are at their peak.

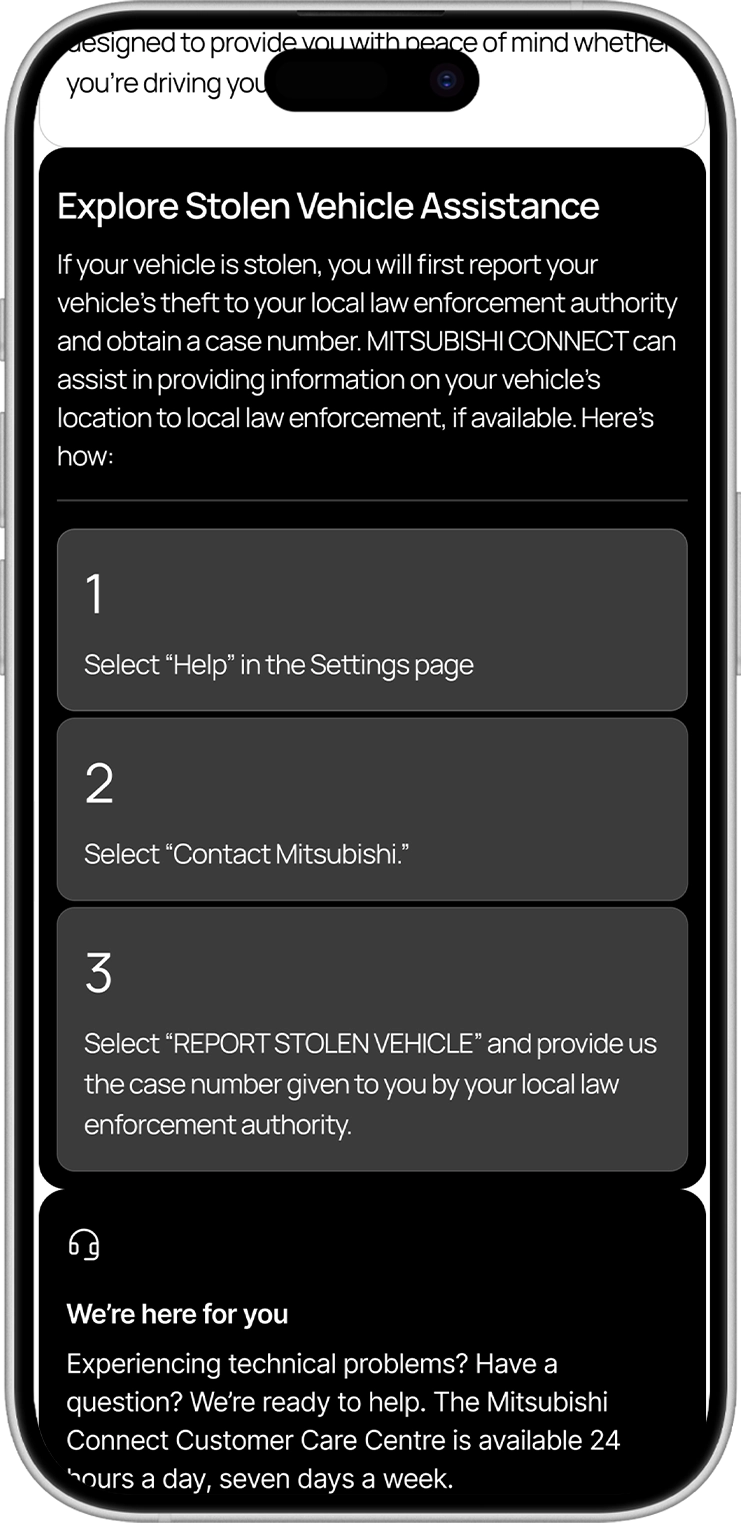

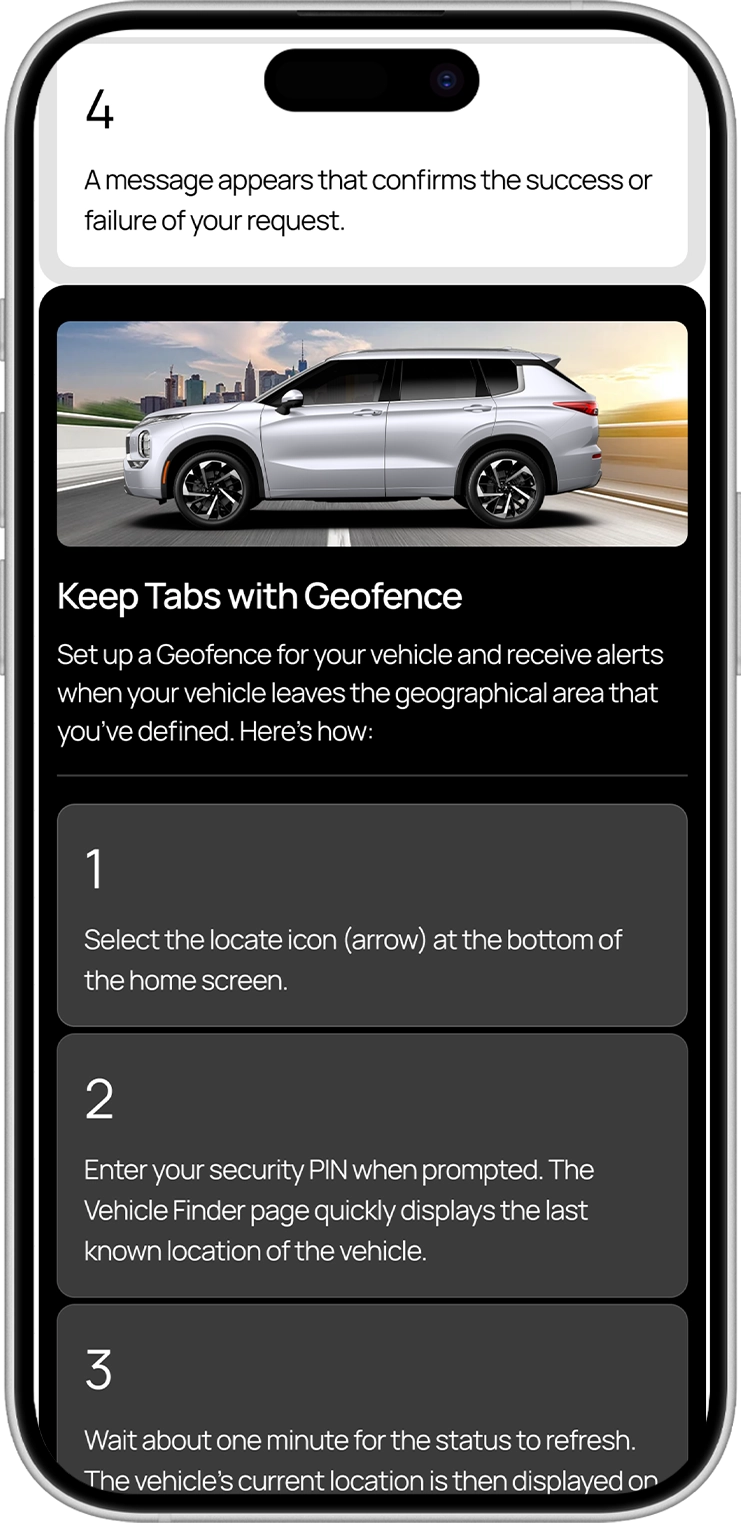

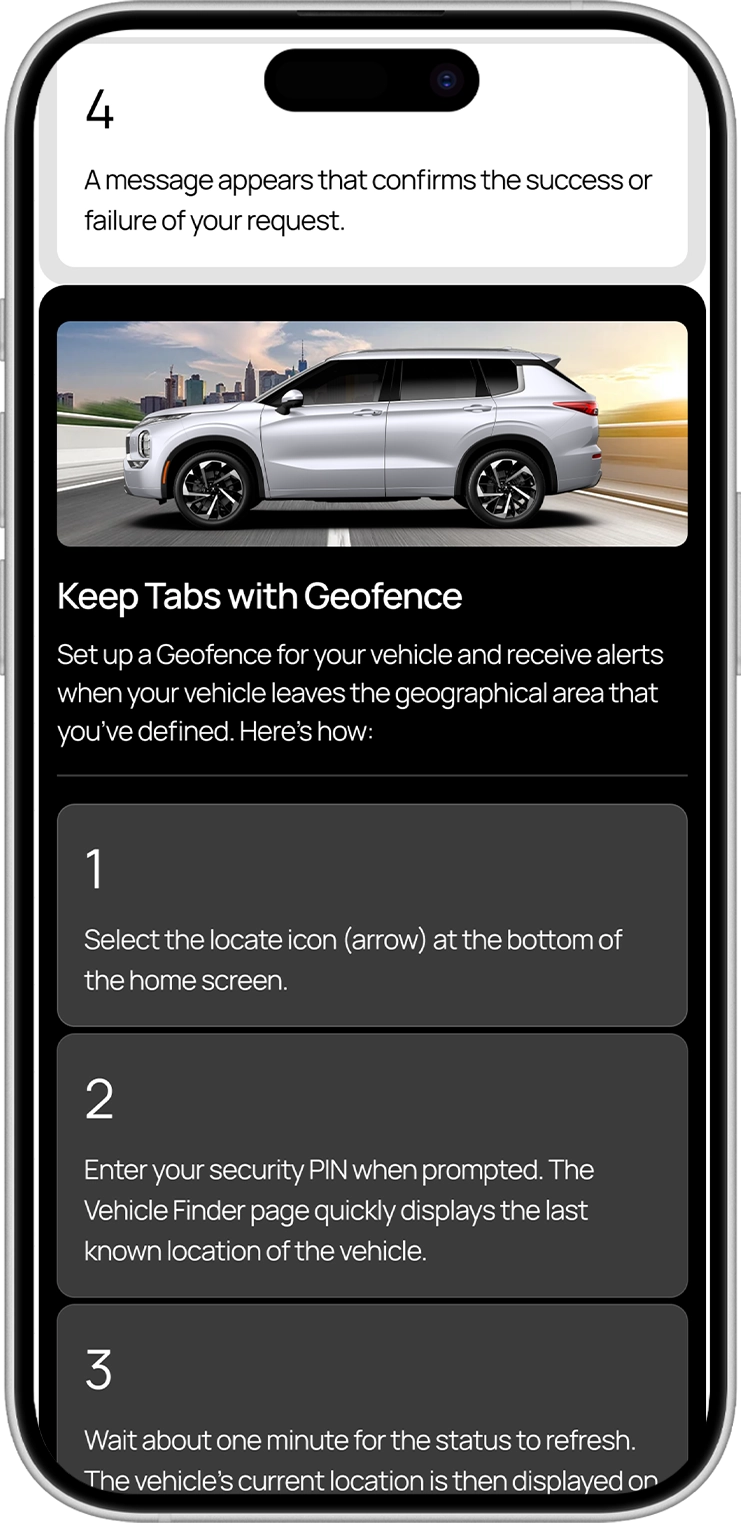

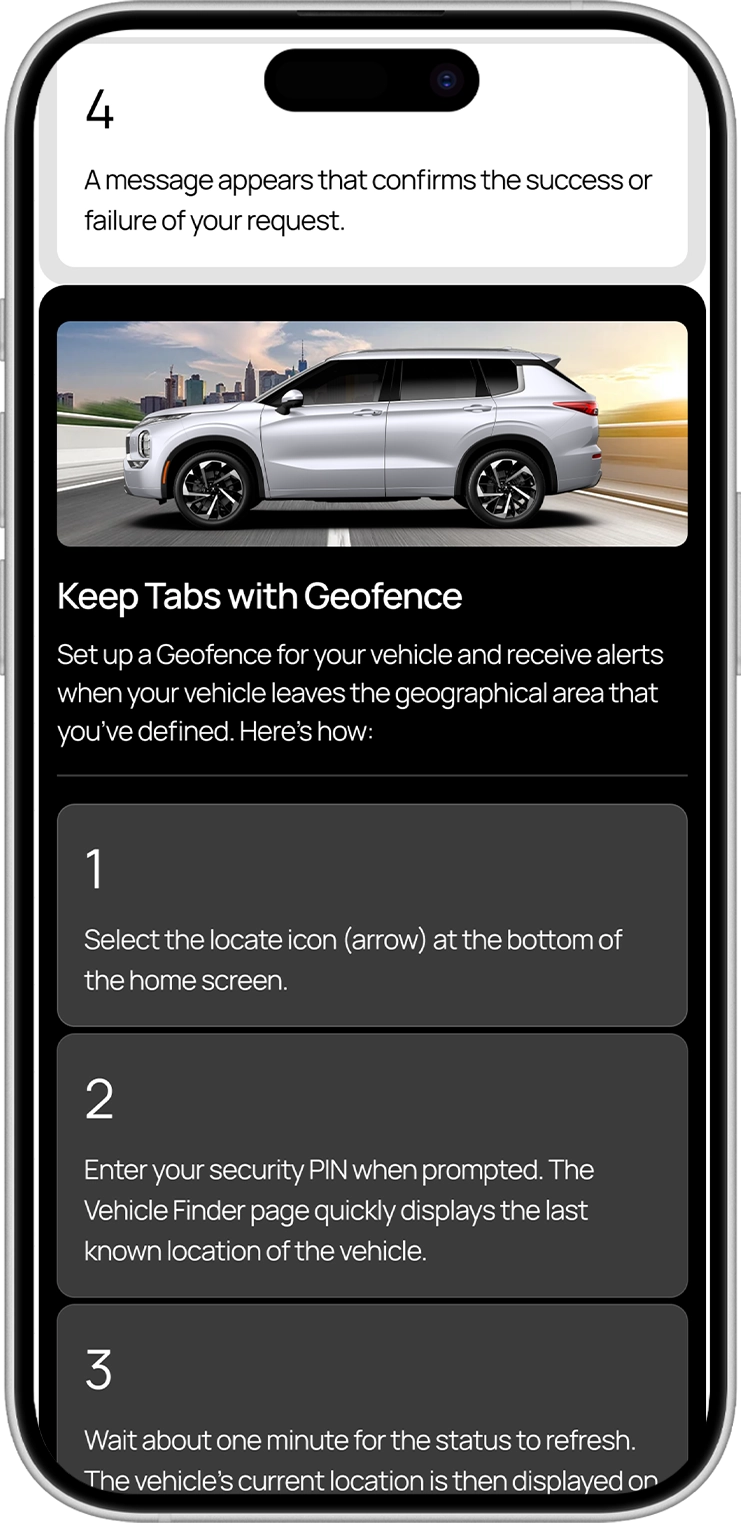

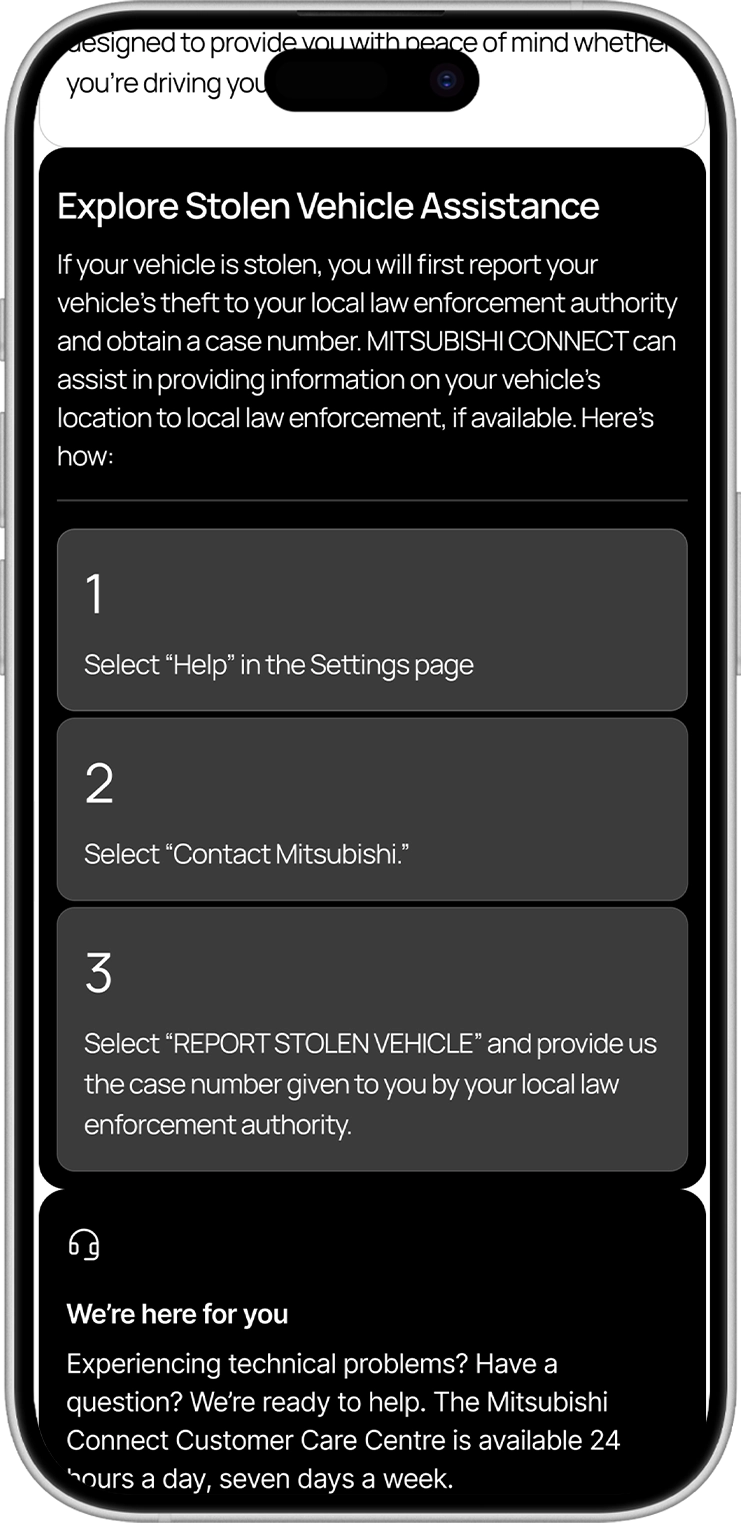

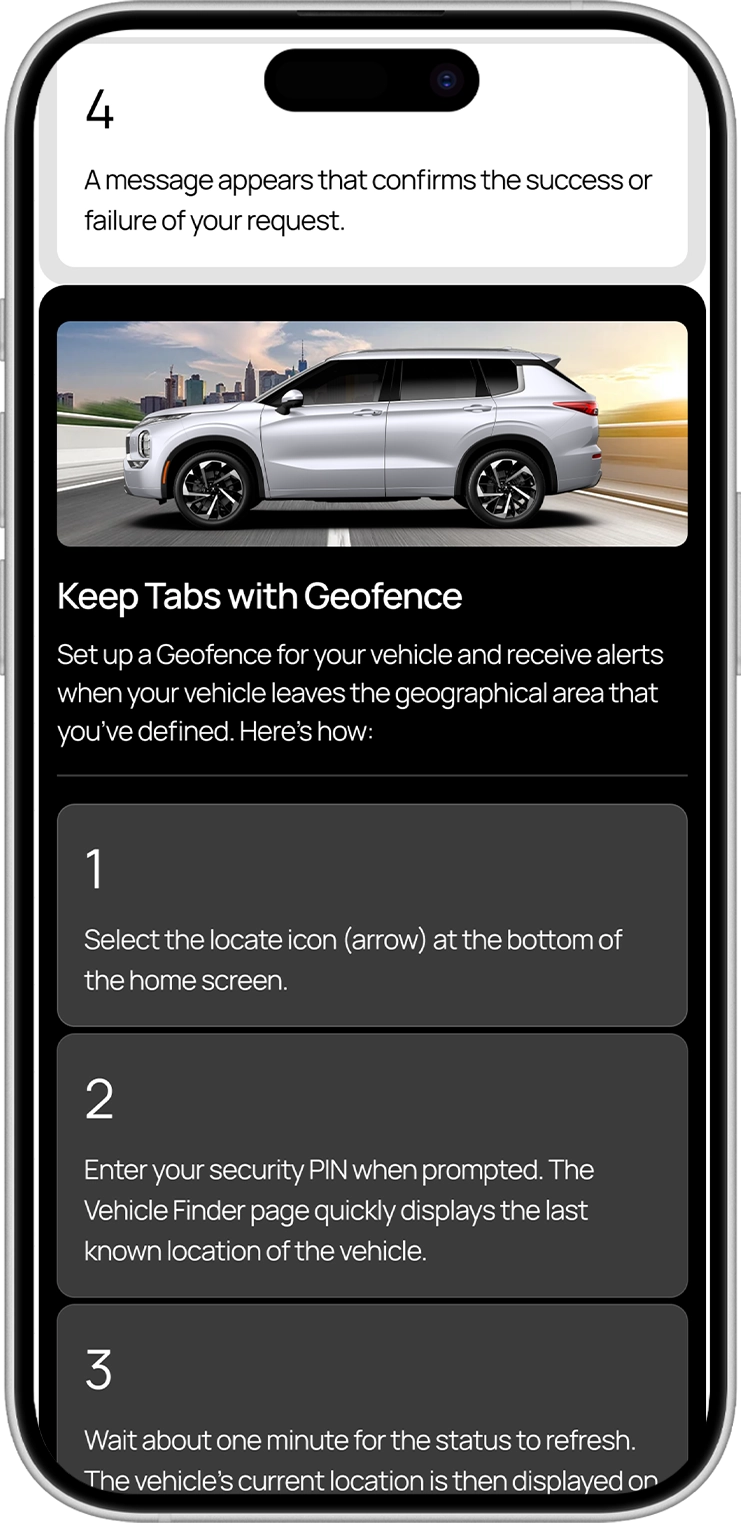

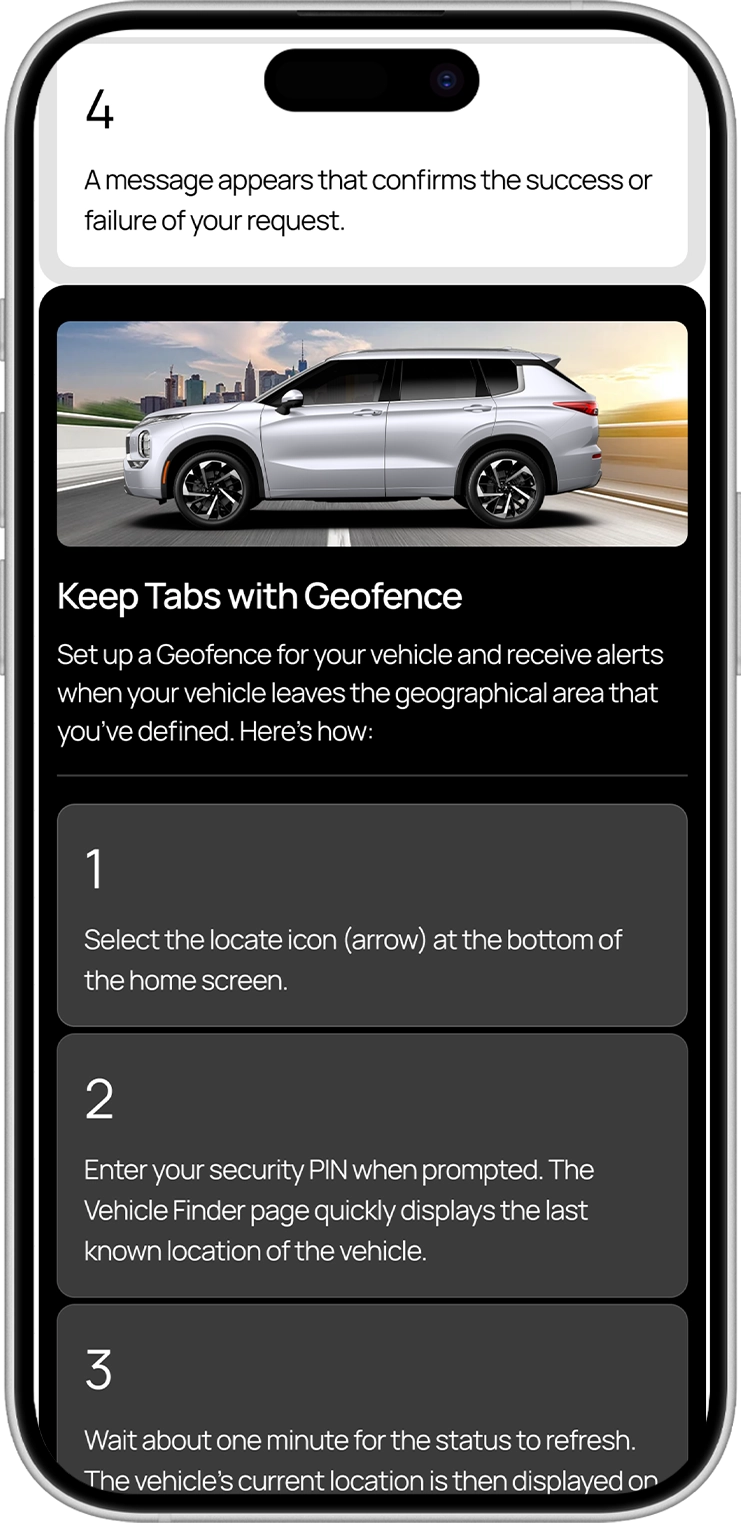

Keep tabs with Geofence

Set up a Geofence for your vehicle and receive alerts when your vehicle leaves the geographical area that you’ve defined. Here's how:

1

Under “Manage Vehicles”, select “Parental Controls.”

2

Select “Geofence” and tap the plus symbol.

3

Select the centre of the setting area on the map.

4

Pinch in and out to adjust the setting area, then select “SAVE.”

5

Enter the setting name, then select “SAVE.”

Vehicle Status Overview

CCS Values shown reflect data as of July 23, 2024. Readings may vary.

Odometer

256km

Tire Pressure

41 psi

42 psi

43 psi

Engine Oil Pressure

Healthy

Time to Service

10,814 km

Brake Fluid Level

Healthy

Proactive Health Management With Vehicle Status Reports

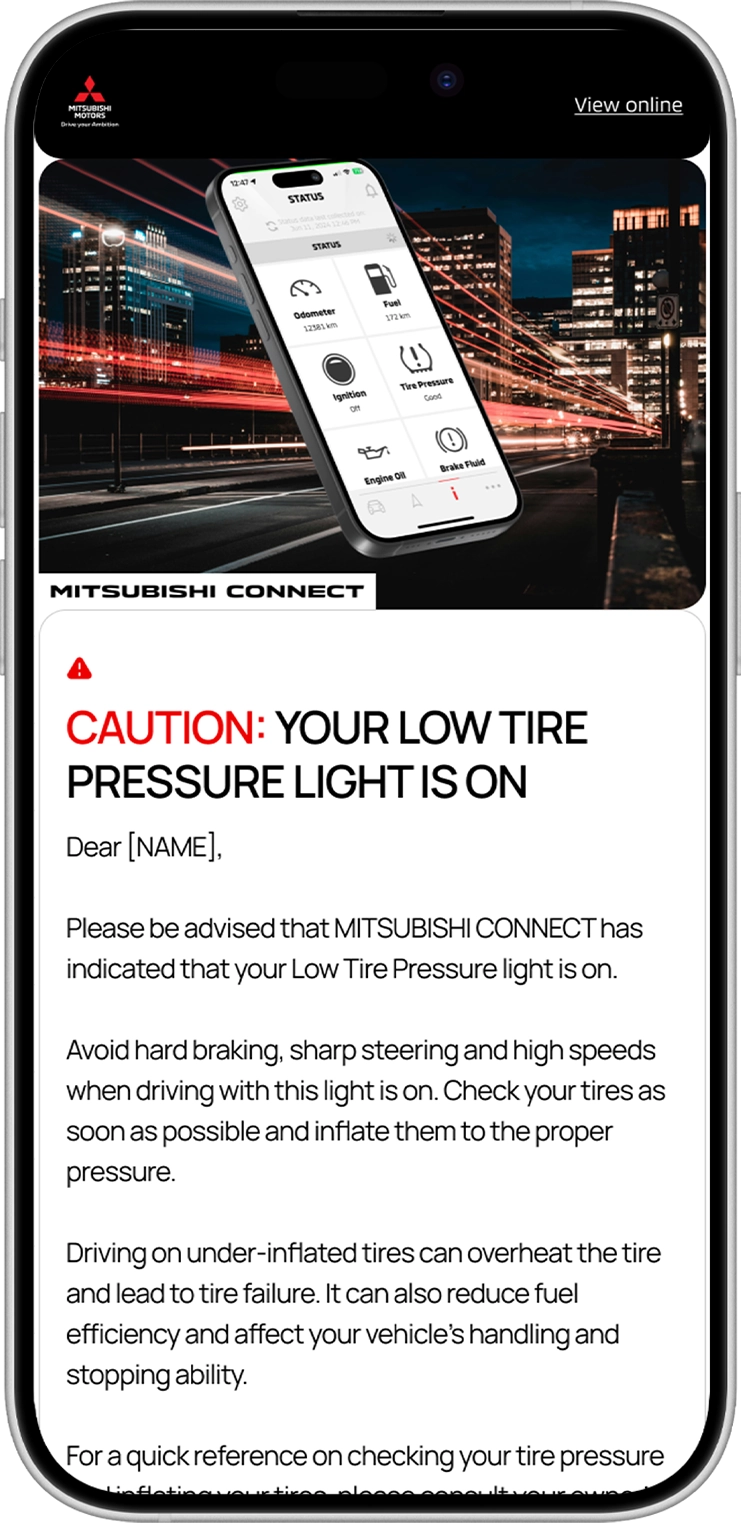

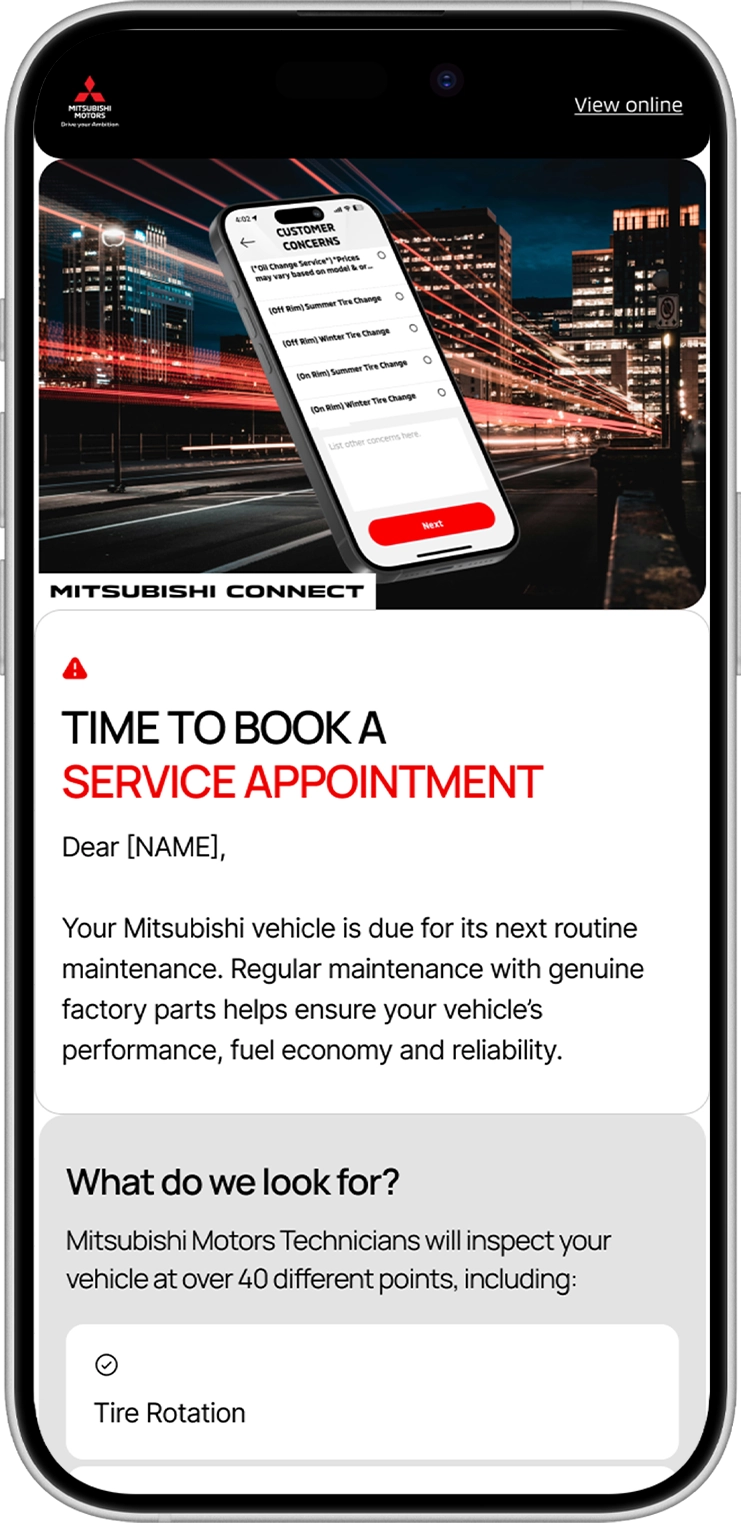

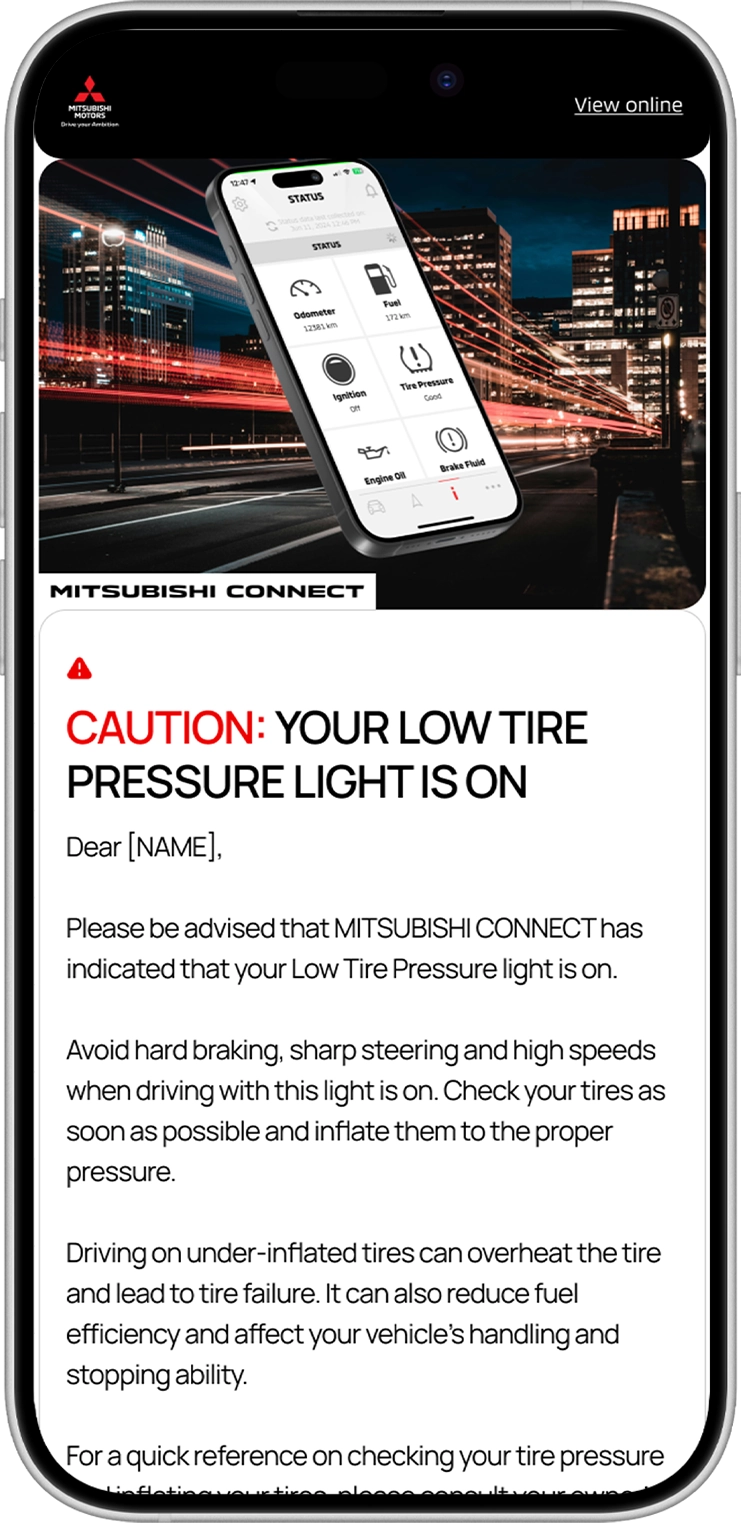

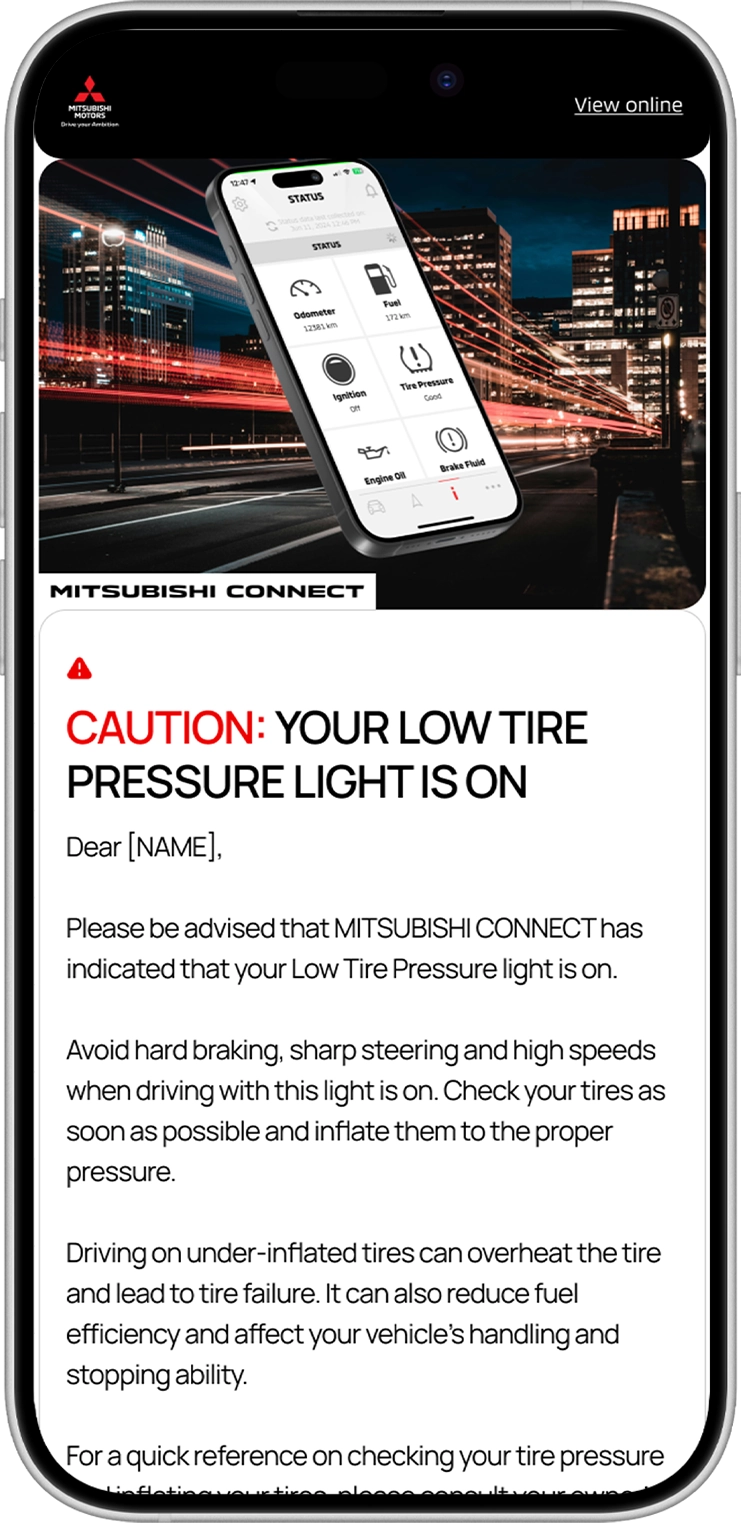

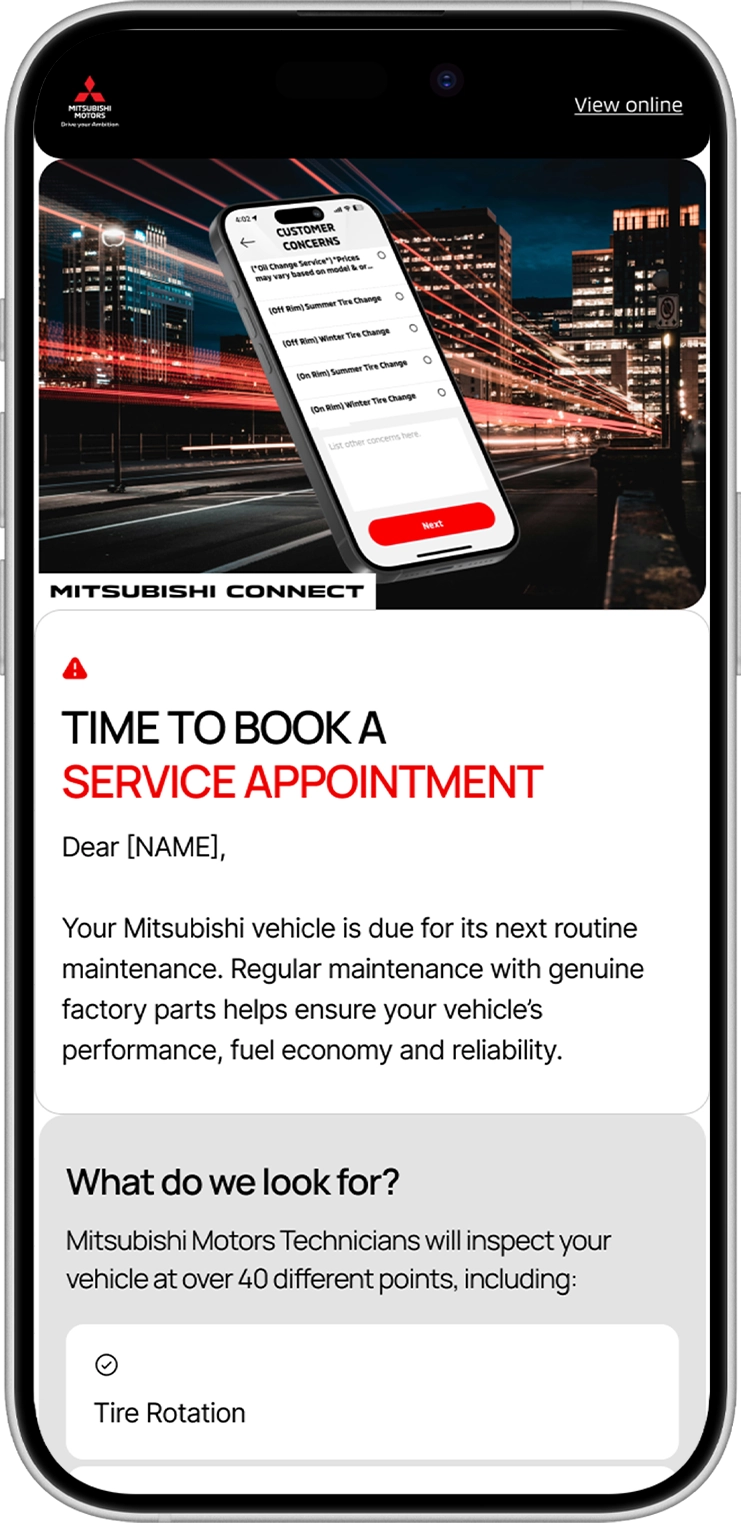

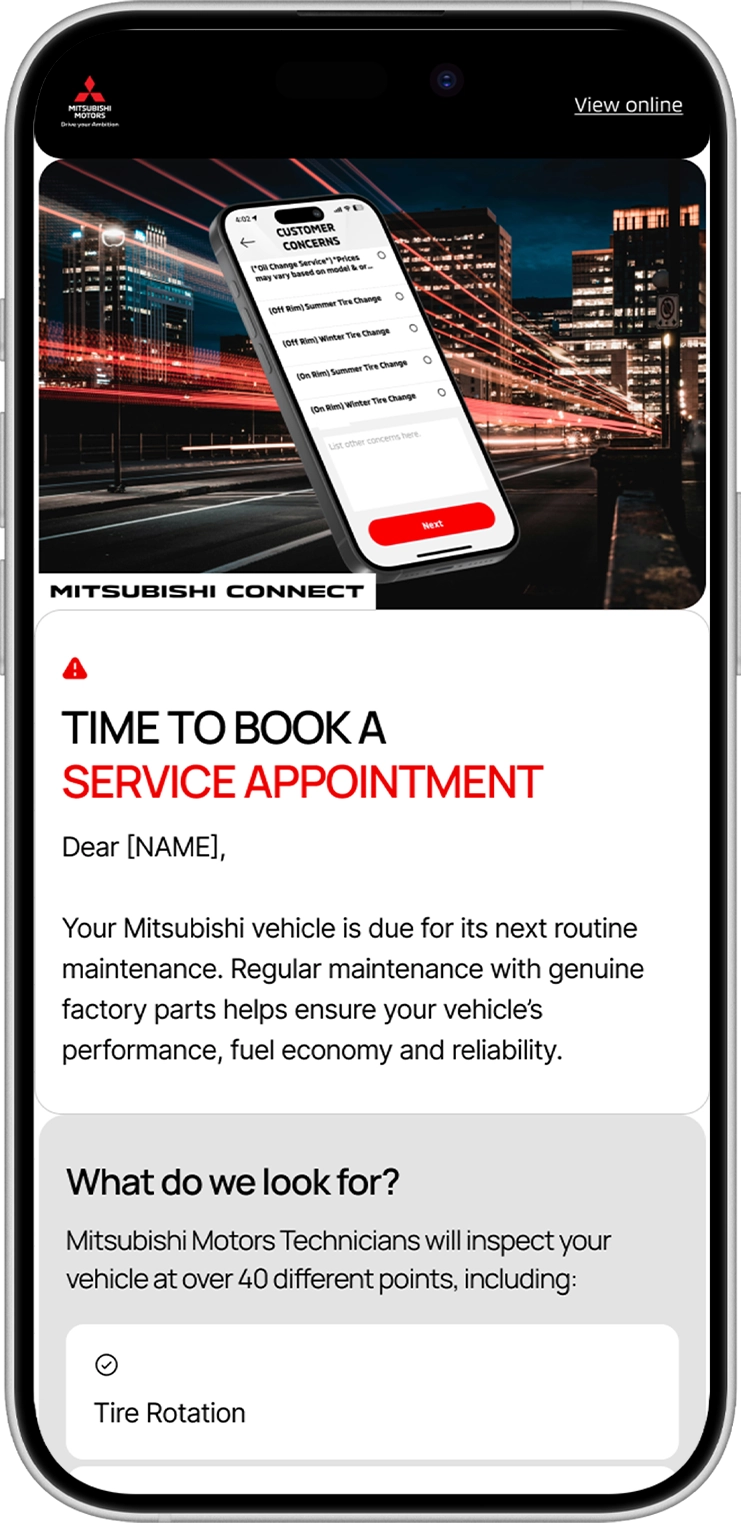

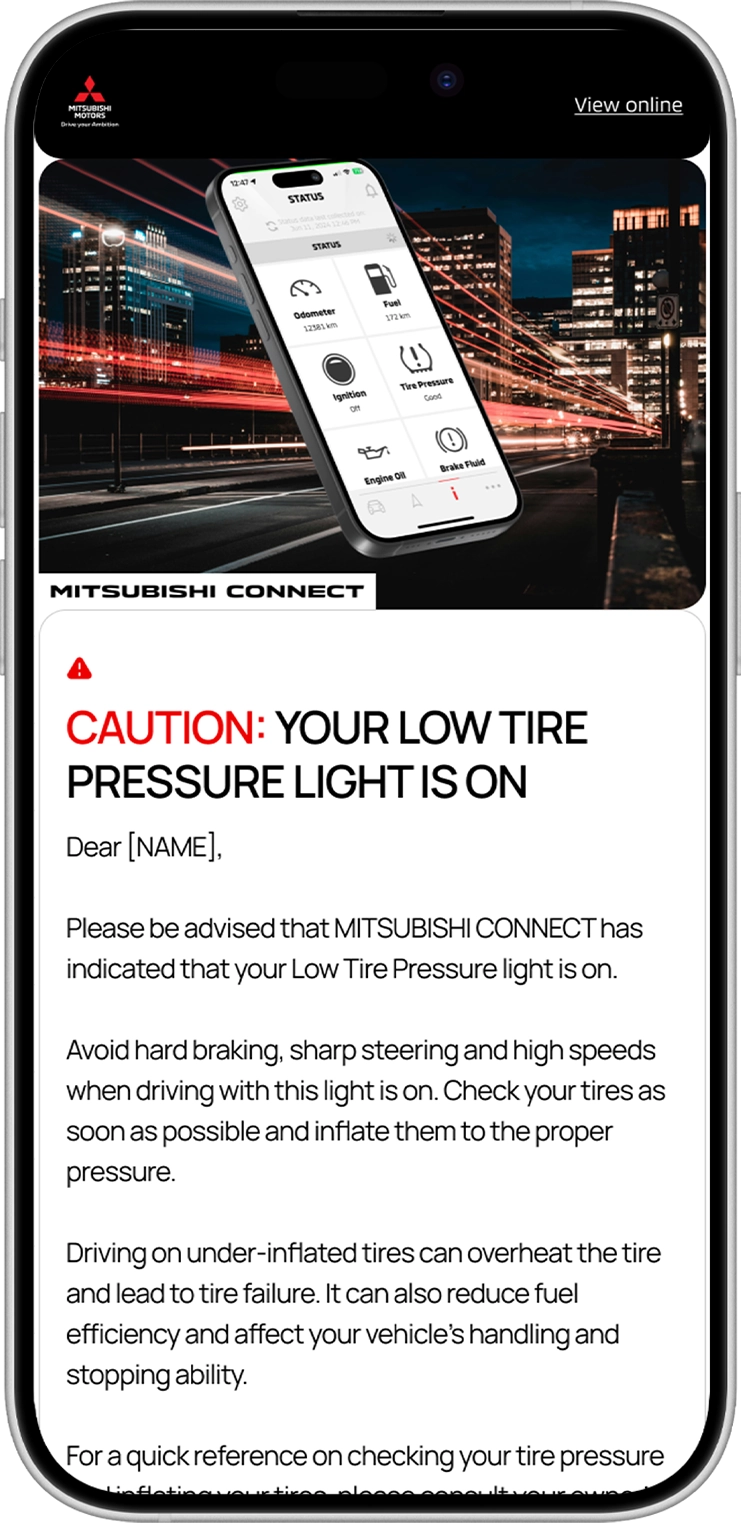

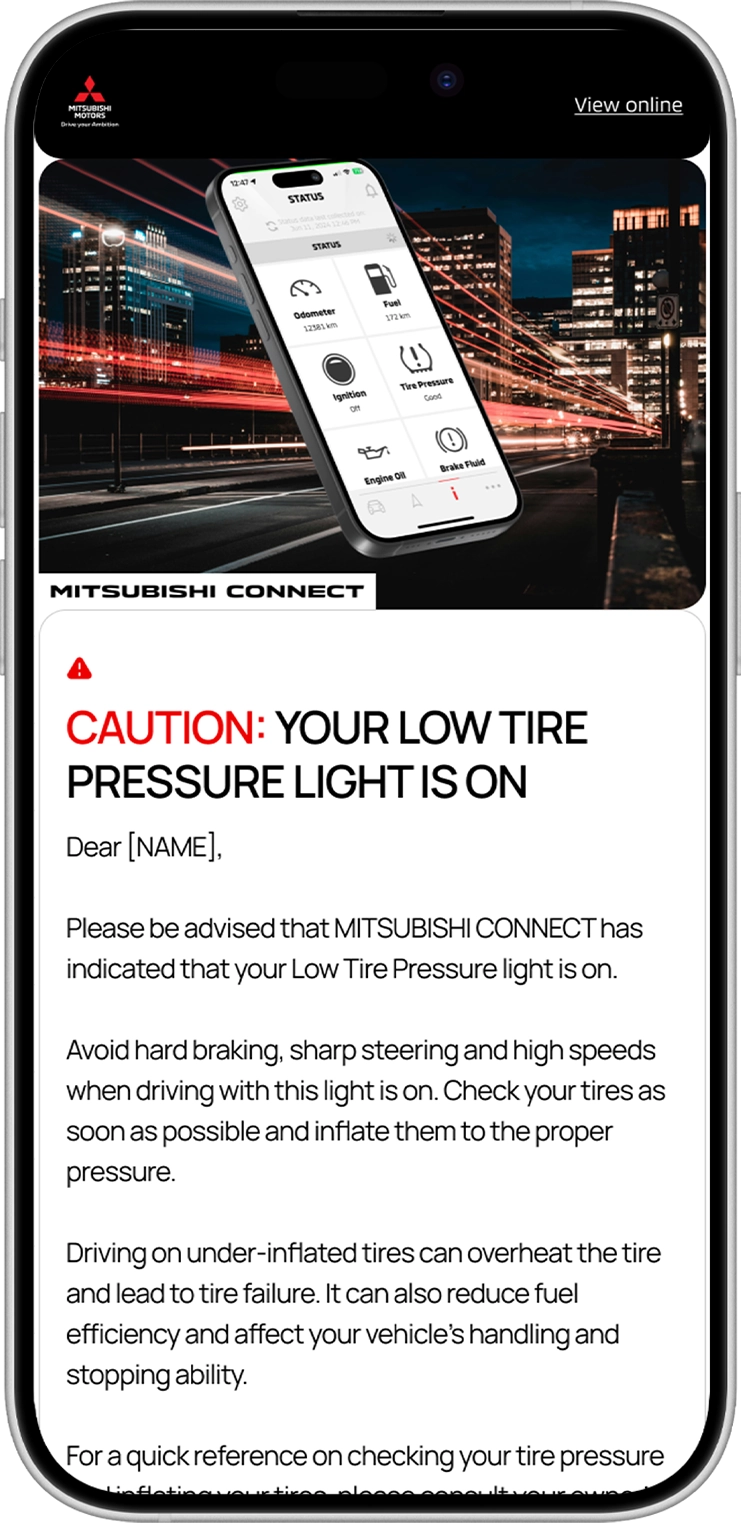

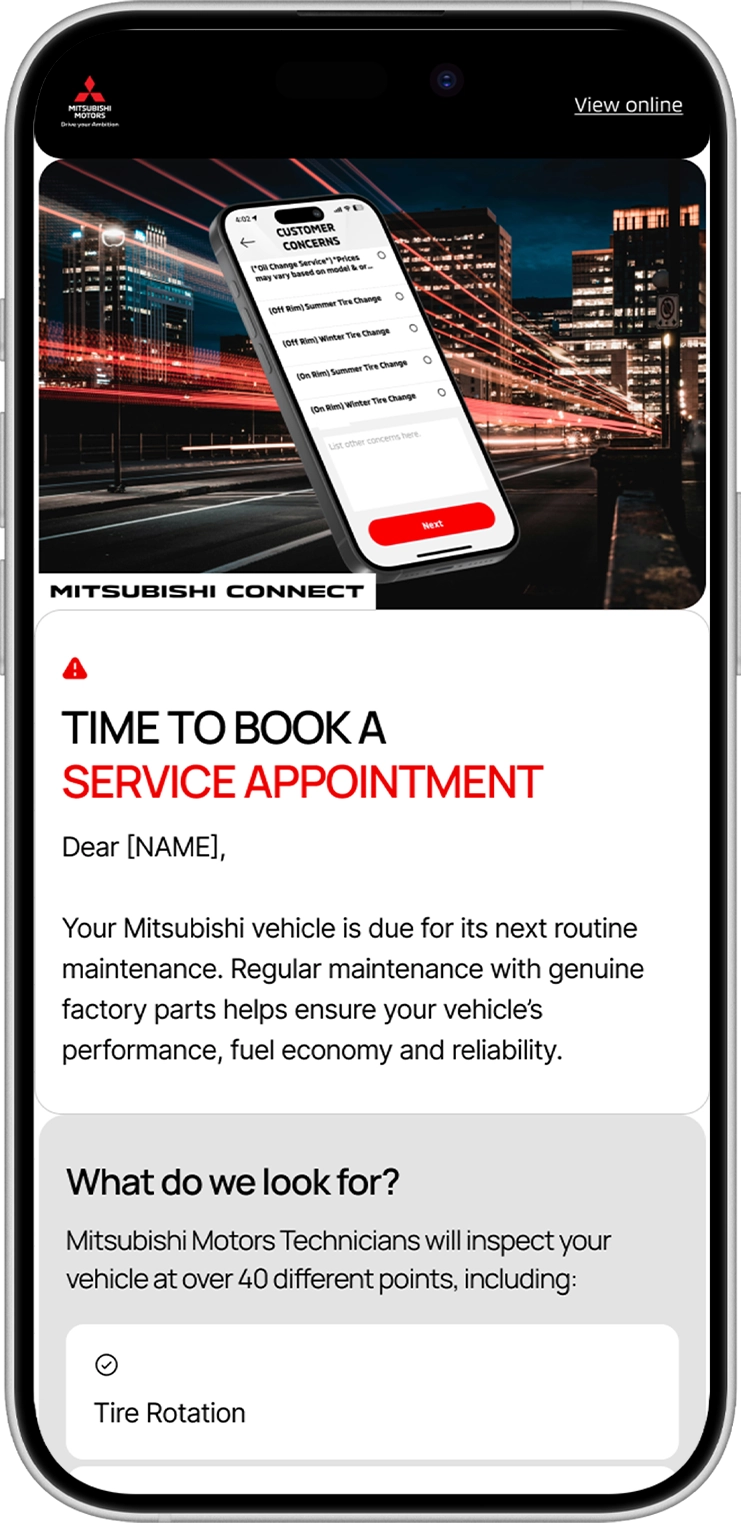

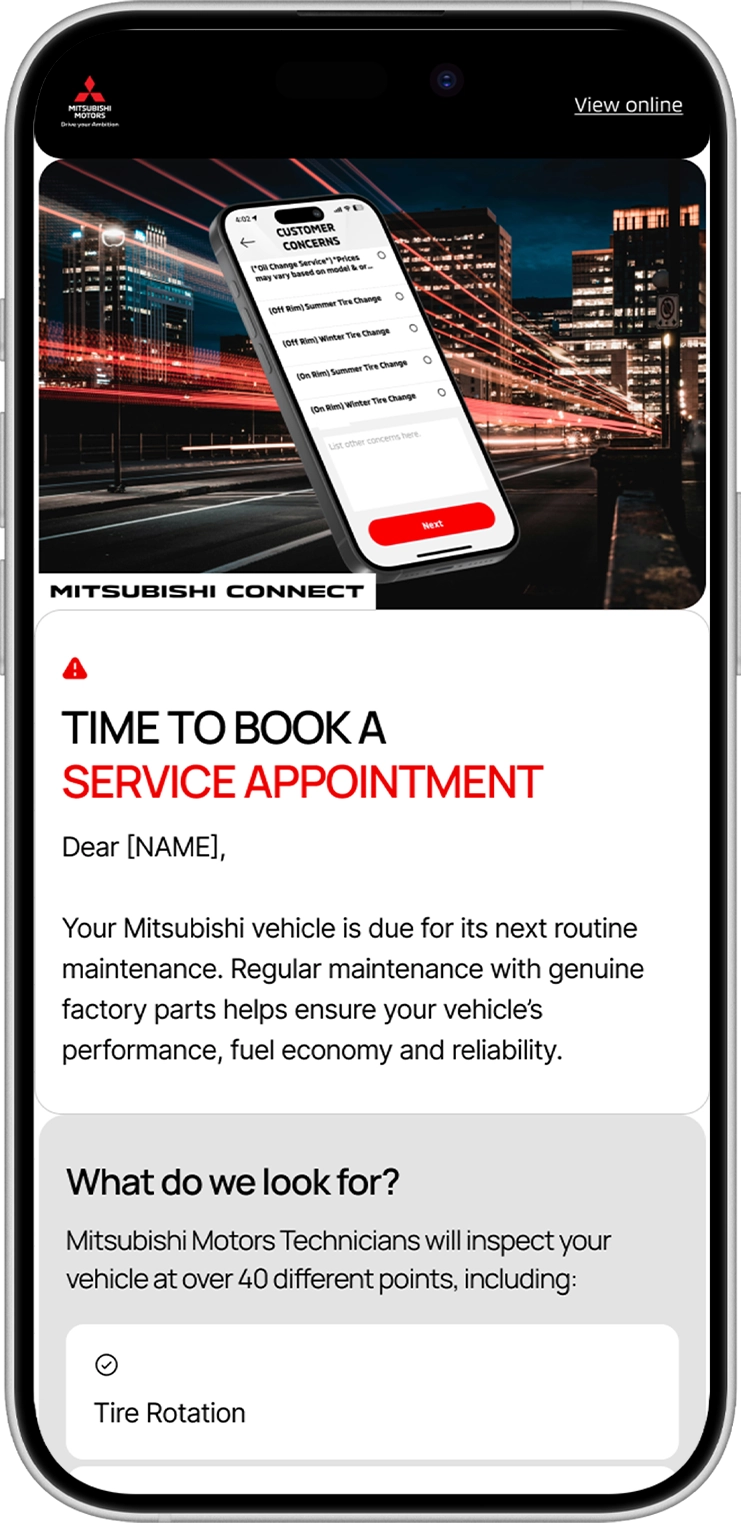

Scheduled Vehicle Status Reports were deployed quarterly to present owners with holistic summaries of key health markers and combat inconsistent dealer instruction related to service requirements and maintenance timing. Safety critical issues, such as low brake fluid, prompted immediate triggers that bypassed the scheduled cadence to deliver urgent notifications with direct resolution pathways, positioning Mitsubishi Connect as a proactive co-pilot that mitigates maintenance uncertainty for owners seeking adventure.

Maximizing Relevance Through Context

Dynamic content served as the catalyst for generating 1:1 messaging frameworks, positioning email as an augmentation of the CCS app's core utility. From populating an owner's specific model, trim, and colour to imbue stickiness above the fold; to sophisticated journey logic featuring contextual triggers that flag anomalies pertaining to key vehicular health markers in real-time, keeping owners informed on-the-go.

Cite All-Wheel Drive as a leading motivator for purchase, hinting at adventurous spirits beneath practical exteriors.

0%

0%

Chose Outlander over competing brands due to Mitsubishi's highly regarded reputation for safety.

0%

0%

State that versatility is a non-negotiable: requiring a vehicle that adapt to changing passenger and cargo needs.

0%

0%

Listed Outlander as their first Mitsubishi vehicle, demonstrating brand ability to capture families at pivotal life transitions.

0%

0%

Remote Vehicle Status

51%

51%

Remote Vehicle Status

51%

51%

Remote Climate Control Start

22%

22%

Remote Climate Control Start

22%

22%

Remote Vehicle Finder

7%

7%

Remote Vehicle Finder

7%

7%

Remote Lock / Unlock

7%

7%

Remote Lock / Unlock

7%

7%

STATE OF THE INDUSTRY

A vehicle isn't the only thing that depreciates when driven off the lot - so too does brand investment in nurturing long-term connections.

Hard-won customer relationships achieved through rigorous multi-channel acquisition strategies wither into radio silence during their most formative periods of ownership - when loyalty foundations are most apt to be cultivated.

State Of The Industry

A vehicle isn't the only thing that depreciates when driven off the lot - so too does brand investment in nurturing long-term connections.

Hard-won customer relationships achieved through rigorous multi-channel acquisition strategies wither into radio silence during their most formative periods of ownership - when loyalty foundations are most apt to be cultivated.

State Of The Industry

A vehicle isn't the only thing that depreciates when driven off the lot - so too does brand investment in nurturing long-term connections.

Hard-won customer relationships achieved through rigorous multi-channel acquisition strategies wither into radio silence during their most formative periods of ownership - when loyalty foundations are most apt to be cultivated.

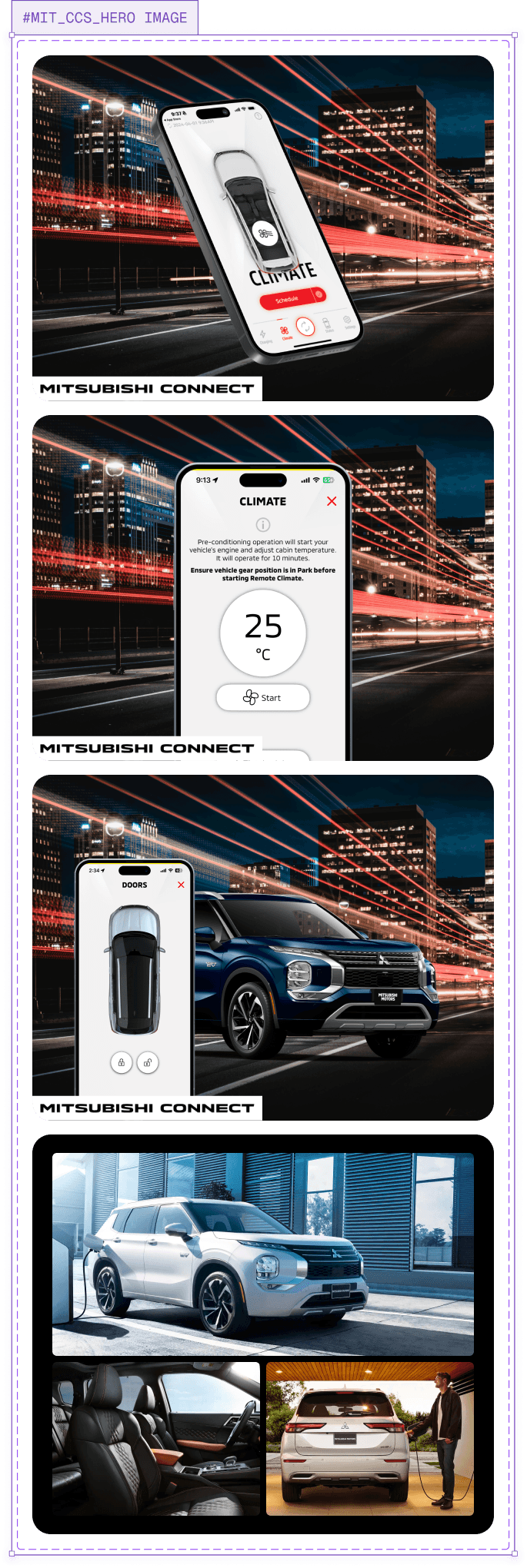

EXTEND EVERYDAY DRIVING WITH MITSUBISHI CONNECT

Fuel Ambition With Mitsubishi Connect

Recognizing the reality of most trips extending beyond just putting it in park, Mitsubishi Connect transcends the traditional constraints of ownership, augmenting your vehicle's utility all from the palm of your hand.

Powered through the Mitsubishi Connect Mobile App, owners are inspired to reimagine a more seamless A-to-B with practical Remote and Safeguard features, alongside real-time service alerts for peace of mind on-the-fly.

Recognizing the reality of most trips extending beyond just putting it in park, Mitsubishi Connect transcends the traditional constraints of ownership, augmenting your vehicle's utility all from the palm of your hand.

Powered through the Mitsubishi Connect Mobile App, owners are inspired to reimagine a more seamless A-to-B with practical Remote and Safeguard features, alongside real-time service alerts for peace of mind on-the-fly.

Fuel Ambition With Mitsubishi Connect

Recognizing the reality of most trips extending beyond just putting it in park, Mitsubishi Connect transcends the traditional constraints of ownership, augmenting your vehicle's utility all from the palm of your hand.

Powered through the Mitsubishi Connect Mobile App, owners are inspired to reimagine a more seamless A-to-B with practical Remote and Safeguard features, alongside real-time service alerts for peace of mind on-the-fly.

PASSENGER PROFILES: WHO'S BEHIND THE WHEEL?

Discovery: Identifying Root Cause

Discovery: Identifying Root Cause

With paid subscription rates for CCS charting well below the benchmark KPI of 20%, we recognized a fundamental disconnect between service usage and perceived value. Discovery research was required to uncover friction points across Mitsubishi's existing communications strategies and isolate root cause. How (and how often) does Mitsubishi articulate CCS' core value propositions to new owners? What in-app features currently possess the highest utilization rates?

In-depth Buyer Profiles containing extensive insights related to demography and purchasing patterns were presented and provided by Mitsubishi's Internal Research Team; serving as a springboard to garner a deeper understanding of our target user base.

With paid subscription rates for CCS charting well below the benchmark KPI of 20%, we recognized a fundamental disconnect between service usage and perceived value. Discovery research was conducted to uncover friction points across Mitsubishi's existing communications strategies and isolate root cause. How (and how often) does Mitsubishi articulate CCS' core value propositions to new owners? What in-app features currently possess the highest utilization rates?

In-depth Buyer Profiles containing extensive insights related to demography and purchasing patterns were presented and provided by Mitsubishi's Internal Research Team; serving as a springboard to garner a deeper understanding of our target user base.

With paid subscription rates for CCS charting well below the benchmark KPI of 20%, we recognized a fundamental disconnect between service usage and perceived value. Discovery research was required to uncover friction points across Mitsubishi's existing communications strategies and isolate root cause. How (and how often) does Mitsubishi articulate CCS' core value propositions to new owners? What in-app features currently possess the highest utilization rates?

Buyer Profiles containing extensive insights related to demography and purchasing patterns were presented and provided by Mitsubishi's Internal Research Team; serving as a springboard to garner a visceral understanding of our target user base.

40%

Cite All-Wheel Drive as a leading motivator for purchase, hinting at adventurous spirits beneath practical exteriors.

59%

Chose Outlander over competing brands due to Mitsubishi's highly regarded reputation for safety.

88%

State that versatility is a non-negotiable: requiring a vehicle that adapt to changing passenger and cargo needs.

82%

Listed Outlander as their first Mitsubishi vehicle, demonstrating brand ability to capture families at pivotal life transitions.

Cite All-Wheel Drive as a leading motivator for purchase, hinting at adventurous spirits beneath practical exteriors.

0%

0%

Chose Outlander over competing brands due to Mitsubishi's highly regarded reputation for safety.

0%

0%

State that versatility is a non-negotiable: requiring a vehicle that adapt to changing passenger and cargo needs.

0%

0%

Listed Outlander as their first Mitsubishi vehicle, demonstrating brand ability to capture families at pivotal life transitions.

0%

0%

Cite All-Wheel Drive as a leading motivator for purchase, hinting at adventurous spirits beneath practical exteriors.

0%

0%

Chose Outlander over competing brands due to Mitsubishi's highly regarded reputation for safety.

0%

0%

SO, WHO'S BEHIND THE WHEEL?

So, Who's Behind The Wheel?

So, Who's Behind The Wheel?

Outlander Owners embody the suburban-dwelling, millennial professional balancing adventure and stability. They're methodical thinkers who approach vehicle ownership as a strategic investment rather than an emotional indulgence.

Insights indicated a compelling hierarchy of feature affinity by model type (Plug-in Hybrid vs. Gas). But, how might these conventions align with those behind the wheel of competing automakers?

Outlander Owners embody the suburban-dwelling, millennial professional balancing adventure and stability. They're methodical thinkers who approach vehicle ownership as a strategic investment rather than an emotional indulgence.

Insights indicated a compelling hierarchy of feature affinity by model type (Plug-in Hybrid vs. Gas). But, how might these conventions align with those behind the wheel of competing automakers?

Outlander Owners embody the suburban-dwelling, millennial professional balancing adventure and stability. They're methodical thinkers who approach vehicle ownership as a strategic investment rather than an emotional indulgence.

Insights indicated a compelling hierarchy of feature affinity by model type (Plug-in Hybrid vs. Gas). But, how might these conventions align with those behind the wheel of competing automakers?

Remote Vehicle Status

51%

51%

Remote Vehicle Status

51%

51%

Remote Climate Control Start

22%

22%

Remote Climate Control Start

22%

22%

Remote Vehicle Finder

7%

7%

Remote Vehicle Finder

7%

7%

Remote Lock / Unlock

7%

7%

Remote Lock / Unlock

7%

7%

Piecing it all together

With competitor email journeys gated behind ownership and VIN, generative community research was conducted through targeted Reddit inquiries; engaging Subaru and Toyota owners directly about their experiences with each manufacturer's remote services programs. Despite price being cited as a top-of-funnel impediment to renewal, respondents attributed a lack of transparency as an underlying conduit for diminished trust in brand. Connected car services were consistently onboarded to new owners as an afterthought during final paperwork; a missed opportunity to foster advocacy through meaningful education and feature demonstration when novelty is at its highest.

Canvassing the Market

With competitor email journeys gated behind ownership and VIN, generative community research was conducted through targeted Reddit inquiries; engaging Subaru and Toyota owners directly about their experiences with each manufacturer's remote services programs. Despite price being cited as a top-of-funnel impediment to renewal, respondents attributed a lack of transparency as an underlying conduit for diminished trust in brand. Connected car services were consistently onboarded to new owners as an afterthought during final paperwork; a missed opportunity to foster advocacy through meaningful education and feature demonstration when novelty is at its highest.

Toyota_landcrusier67

The total cost-to-value just isn't there for me. Wish I could renew specific features instead of a blanket subscription to better accommodate my needs.

1

RAV4_Explorer87

I was informed about my Connected Car Services as an afterthought before driving off the lot. Haven't heard about it since, and still unsure what it's all about tbh...

2

Subi_dooby_doo12

Remote Start and Remote Lock / Unlock are my saviours as a daily commuter. Not sure what other features I'd take advantage of consistently though...

2

HighlanderToyota_Dad_091

I've owned Toyota's since my '94 RAV4. I'll be looking elsewhere for my next vehicle. I can use my fob for remote unlocking and Carplay for my nav. What else is there to pay for?

4

Subaru_Owner762

The only major value point during my trial has been keeping track of my teenagers with Vehicle Alerts. Not sure what else I'd see as valuable enough to pay for...

3

Canvassing the Market (Tap to uncover insights)

With competitor email journeys gated behind ownership and VIN, generative community research was conducted through targeted Reddit inquiries; engaging Subaru and Toyota owners directly about their experiences with each manufacturer's remote services programs. Despite price being cited as a top-of-funnel impediment to renewal, respondents attributed a lack of transparency as an underlying conduit for diminished trust in brand. Connected car services were consistently onboarded to new owners as an afterthought during final paperwork; a missed opportunity to foster advocacy through meaningful education and feature demonstration when novelty is at its highest.

Plug-&-Play: Democratizing Systems

Plug-&-Play: Democratizing Systems

Our approach to system design development was rooted in adaptability: empowering client with a groundwork of semantically labelled tokens to serve as a springboard for future refinement and scale. Success was defined through the system's proficiency in democratizing technical constraints; inviting participation from less-technical teams in the effort of identifying efficiencies and opportunities for additions.

Habit Forming During Peak Receptivity Periods

Habit Forming During Peak Receptivity Periods

The first 30 days represented strategic bets informed through existing owner insights and core purchase motivators, front-loading communications with high-affinity feature spotlights (i.e. Remote Climate Control, Vehicle Status monitoring, and Door Lock functions) to maximize perceived ecosystem value and foster habitual use when open rates (and brand engagement) are at their peak.

Maximizing Relevance Through Context

Maximizing Relevance Through Context

Dynamic content served as the catalyst for generating 1:1 messaging frameworks, positioning email as an extension of the CCS app's core utilities. From populating an owner's specific model, trim, and colour to imbue stickiness above the fold; to sophisticated journey logic featuring contextual triggers that flag anomalies pertaining to key vehicular health markers in real-time, keeping owners informed on-the-go.

Vehicle Status Overview

CCS Values shown reflect data as of July 23, 2024. Readings may vary.

Odometer

256km

Tire Pressure

41 psi

42 psi

43 psi

Engine Oil Pressure

Healthy

Time to Service

10,814 km

Brake Fluid Level

Healthy

Keep tabs with Geofence

Set up a Geofence for your vehicle and receive alerts when your vehicle leaves the geographical area that you’ve defined. Here's how:

1

Under “Manage Vehicles”, select “Parental Controls.”

2

Select “Geofence” and tap the plus symbol.

3

Select the centre of the setting area on the map.

4

Pinch in and out to adjust the setting area, then select “SAVE.”

5

Enter the setting name, then select “SAVE.”

Proactive Health Management With Vehicle Status Reports

Proactive Health Management With Vehicle Status Reports

Scheduled Vehicle Status Reports were deployed quarterly to present owners with holistic summaries of key health markers and combat inconsistent dealer instruction related to service requirements and maintenance timing. Safety critical issues, such as low brake fluid, prompted immediate triggers that bypassed the scheduled cadence to deliver urgent notifications with direct resolution pathways, positioning Mitsubishi Connect as a proactive co-pilot that mitigates maintenance uncertainty for owners seeking adventure.

Driving Contextual Relevance

Driving Contextual Relevance

Dynamic content served as the catalyst for generating 1:1 messaging frameworks, positioning email as an augmentation of the CCS app's core utility. From populating an owner's specific model, trim, and colour to imbue stickiness above the fold; to sophisticated journey logic featuring contextual triggers that flag anomalies pertaining to key vehicular health markers in real-time, keeping owners informed on-the-go.

Solution Architecture

Solution Architecture

Pixel pushing was preceded by data architecture and content bucketing. Our team collaborated with Strategy through a series of synchronous workshop sessions; crafting journey logic to accommodate dynamic, model-specific feature spotlights and contextual triggers that inform owners of safety critical nuances on-the-go. Data markers currently being tracked via CCS on the backend were repurposed to serve as immediate trigger communications that put CCS in the passenger seat.

Engineering Habit-Forming

Engineering Habit-Forming

The first 30 days represented strategic bets informed through existing owner insights and core purchase motivators, front-loading communications with high-affinity feature spotlights (i.e. Remote Climate Control, Vehicle Status monitoring, and Door Lock functions) to maximize perceived ecosystem value and foster habitual use when open rates (and brand engagement) are at their peak.

Keep tabs with Geofence

Set up a Geofence for your vehicle and receive alerts when your vehicle leaves the geographical area that you’ve defined. Here's how:

1

Under “Manage Vehicles”, select “Parental Controls.”

2

Select “Geofence” and tap the plus symbol.

3

Select the centre of the setting area on the map.

4

Pinch in and out to adjust the setting area, then select “SAVE.”

5

Enter the setting name, then select “SAVE.”

Vehicle Status Overview

CCS Values shown reflect data as of July 23, 2024. Readings may vary.

Odometer

256km

Tire Pressure

41 psi

42 psi

43 psi

Engine Oil Pressure

Healthy

Time to Service

10,814 km

Brake Fluid Level

Healthy

Proactive Health Management

Proactive Health Management

Quarterly Vehicle Status Reports present a holistic summary of key health markers; combating inconsistent dealer instruction related to service requirements and maintenance timing. Safety critical issues, such as low brake fluid, prompted immediate triggers that bypassed this scheduled cadence to deliver urgent notifications with direct resolution pathways, positioning Mitsubishi Connect as a proactive co-pilot that mitigates maintenance uncertainty for owners seeking adventure.

Solution Architecture

Solution Architecture

Pixel pushing was preceded by data architecture and content bucketing. Our team collaborated with Strategy through a series of synchronous workshop sessions; crafting journey logic to accommodate dynamic, model-specific feature spotlights and contextual triggers that inform owners of safety critical nuances on-the-go.

Plug-&-Play: Democratizing Systems

Plug-&-Play: Democratizing Systems

Our approach to system design development was rooted in adaptability: empowering client with a groundwork of semantically labelled tokens to serve as a springboard for future refinement and scale. Success would be scaled through its ability to democratize technical constraints and invite cross-functional engagement in identifying new component requirements and efficiencies.

Outcomes & What's Next

A revitalized CCS email journey found its success through its ability to standardize program identity at brand level, garnering advocacy through contextual awareness. By permeating in-app value propositions across communication channels, we instil the confidence that imbues the adventure Mitsubishi owners seek.

54%

Increase in paid subscription rates from 13.8% to 21.3% QoQ, surpassing the pre-sprint KPI of 20%, and transforming trial users into loyal advocates who perceive CCS as an invaluable digital companion.

70%

Higher click-through rates for Service Reminder triggers compared to all other CCS touchpoints, reinforcing owner affinity for guided a

Outcomes & What's Next

A revitalized CCS email journey found its success through its ability to standardize program identity at brand level, garnering advocacy through contextual awareness. By permeating in-app value propositions across communication channels, we instil the confidence that imbues the adventure Mitsubishi owners seek.

70%

Higher click-through rates for Service Reminder triggers compared to all other CCS touchpoints, reinforcing owner affinity for guided a

54%

Increase in paid subscription rates from 13.8% to 21.3% QoQ, surpassing the pre-sprint KPI of 20%, and transforming trial users into loyal advocates who perceive CCS as an invaluable digital companion.

Outcome Synposis

Outcome Synposis

A revitalized CCS email journey found its success through its ability to standardize program identity at brand level, garnering advocacy through contextual awareness. By permeating in-app value propositions across communication channels, we instil the confidence that imbues the adventure Mitsubishi owners seek.

70%

Higher click-through rates for Service Reminder triggers compared to all other CCS touchpoints, reinforcing owner affinity for guided a

54%

Increase in paid subscription rates from 13.8% to 21.3% QoQ, surpassing the pre-sprint KPI of 20%, and transforming trial users into loyal advocates who perceive CCS as an invaluable digital companion.